A Comparison of Recent “Unprecedented” Rallies in the Dow Jones

You may have been hearing commentaries about the “unprecedented” rally we’re experiencing that doesn’t seem to want to peak any time soon.

I thought it would be a good idea to look back on recent rallies from 1995 forward – using the Dow Jones as a proxy – and compare prior “non-stop” market rallies to the current rally phase off the March 2009 low.

While not earth-shattering, the charts did turn up some interesting observations. Let’s see them.

First, let’s start with three measures of our current rally:

All values are close estimates, and are created with TradeStation.

The rally from the March 2009 low has moved up 68.5% or 4,400 points in a year. The rally has not been ‘non-stop,’ as shown here with two pullbacks.

If you compare the July 2009 low to the January 2010 peak, that ‘non-stop’ rally was 32.5% or 2,600 points.

And if you zoom the perspective in to our current rally off the February 2001 low to present, the rally there has – so far – been 1,075 points or 11%.

We’ll use these three measures as benchmarks for comparing recent ‘non-stop’ rallies.

Let’s travel back in time to the 2006/2007 rally:

Starting with the July 2006 low and moving to the February 2007 high (ouch – I remember that sell-off that came suddenly after the market was ‘grossly’ overextended at that time too). That rally was over 2,100 points or roughly 20%.

After that February sell-off – at which time people were calling 12,750 a market “top,” price rallied in yet another almost identical ‘non-stop’ rally the same number of points (2,117) which was 17.5%.

As many of you are aware, this was still not the market peak – as price rallied one more time (after a sharp pullback) to peak in October 2007 at 14,200.

If anything, this should serve as a warning for those who just love calling market tops – tops can be a long, drawn out process that – while you’ll eventually be right – you might see the market make a few more ‘unexpected’ peaks along the way… but that’s another story for another blog post.

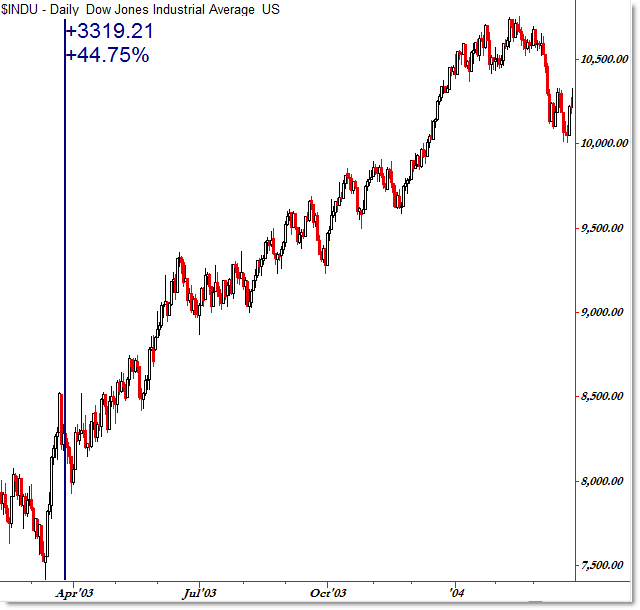

The prior “non-stop” rally came off the 2003 Bear Market low:

I remember this market bottom as well, as President Bush announced that “combat operations were beginning in Iraq” and many people suspected that the market would careen to new lows as America entered a foreign war. As it was, that was the final bottom of the 3-year bear market.

Keep in mind that this bottom also took three times to form, making calling bottoms difficult as well (the official low was in October 2002).

Still, this ‘non-stop’ rally took price from the 7,500 level to the 10,500 level, 3,300 points and 45% higher before the market took a break, consolidating into early 2004.

From personal observation, I remember widespread doubt during this time that the market could sustain the rally… which was similar to late 2006 and 2007.

However, the rallies before this – during widespread economic expansion – were anything but doubtful. In fact, some people were downright euphoric (especially in regard to the NASDAQ).

Keep in mind that the Dow Jones rally (rallies) were less dynamic than the NASDAQ, and so we don’t have the wild euphoric non-stop rally as clearly defined as the NASDAQ. The Dow’s fall was less violent as well… relatively speaking.

Here is the Dow Jones ‘bull market’ non-stop rally during the “internet boom” of 1998/2000:

The period from the October 1998 low to the August 1999 peak represent the “magnificent” rally in the Dow, which took price from 7,500 to 11,000 (almost identical to the 2003 recovery, actually) or up 53%.

And although I could keep going back through history and showing similar 40/50% ‘non-stop’ rallies, I’ll stop the wheels of time here at 1995:

This really was a non-stop rally, and I don’t think it gets the kind of attention other rallies get… at least I haven’t heard many people recently say “Gosh, do you remember the 1995 rally! Wow!”

The index rose 1,600 points or 45% from early 1995 until the end of the year in a literal non-stop fashion (except for a slight mid-year pullback in August).

Take some time to study these charts and realize that markets can and do rally without end… well that’s not entirely true. All markets peak, and sometimes when a market peaks, the downside move can be very swift and very violent.

That brings up the dilemma traders (not so much investors) face when confronted with a non-stop rally.

If you try to short it (call a top), then you risk a death by a thousand cuts, as price creeps steadily and surely against you.

However, if you hold on euphorically and blindly long (and overleveraged), you risk waking up one morning to have a market crash, or at a minimum, a steep retracement.

What’s a trader to do? That could be the subject of a whole series of blog posts!

Thoughts?

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey, are there any “tell-tails,” technically, fundamentally, politically, socially that seem to accompany tops? I would guess the herd mentality is recognizable somewhere in the data???

Hey Justin!

Gosh, there have been entire books written on that subject, so a single comment can't cover it.

Some of the things are contradictory.

Some tops end in euphoria/collapse (think 2000 and to an extent 1987).

Others end quietly with obvious non-confirmations/negative volume, breadth, and momentum divergences.

Fundamentally, market tops occur when news is good, not bad (markets bottom when news & fundamentals are bad). The Socio-economics team has a great deal of research on social mood and market trends, so I'd recommend checking that out.

There's no easy answer, and as you see, price can make a double or triple top and frustrate both bulls and bears at tops and bottoms! They never ring a bell at tops!

This is different from others. In each of the previous cases U.S. had less debt and was the growth engine of the world. From 96 to 2000 U.S. was the center of hi tech, high paying jobs, low unemployment and growing 401Ks.

However this time, U.S. is heavily in debt, high unemployment and deflating prices and that is the reason I do not believe in this rally. It is a manufactured rally and once the banks dump their stocks to retail investors as they have in the past ten years the rally fades.

One more thing to mention, has anyone noticed the divergences in this market, plus over night buying of ES?

Hi,

Corey I would request you to have a relook on GANN FAN there is something interesting going on there

Corey, are there any “tell-tails,” technically, fundamentally, politically, socially that seem to accompany tops? I would guess the herd mentality is recognizable somewhere in the data???

Hey Justin!

Gosh, there have been entire books written on that subject, so a single comment can't cover it.

Some of the things are contradictory.

Some tops end in euphoria/collapse (think 2000 and to an extent 1987).

Others end quietly with obvious non-confirmations/negative volume, breadth, and momentum divergences.

Fundamentally, market tops occur when news is good, not bad (markets bottom when news & fundamentals are bad). The Socio-economics team has a great deal of research on social mood and market trends, so I'd recommend checking that out.

There's no easy answer, and as you see, price can make a double or triple top and frustrate both bulls and bears at tops and bottoms! They never ring a bell at tops!

This is different from others. In each of the previous cases U.S. had less debt and was the growth engine of the world. From 96 to 2000 U.S. was the center of hi tech, high paying jobs, low unemployment and growing 401Ks.

However this time, U.S. is heavily in debt, high unemployment and deflating prices and that is the reason I do not believe in this rally. It is a manufactured rally and once the banks dump their stocks to retail investors as they have in the past ten years the rally fades.

One more thing to mention, has anyone noticed the divergences in this market, plus over night buying of ES?

Hi,

Corey I would request you to have a relook on GANN FAN there is something interesting going on there especially with the dowjones.