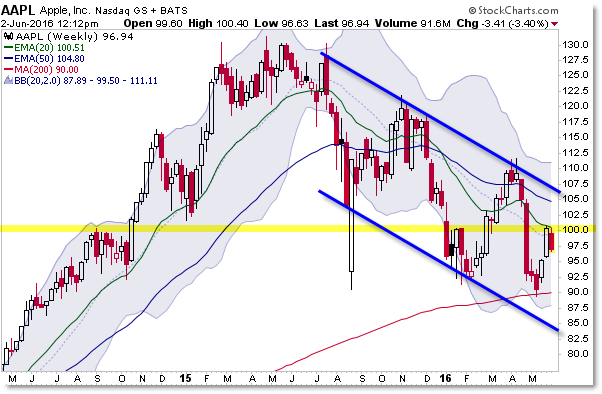

Apple AAPL Trades Down Away from Resistance Target

After springing a Bear Trap and surging higher, Apple (AAPL) shares achieved a key target and are now trading quickly lower.

Take a moment to review our earlier post “Beware the Apple Trapple” which was indeed what happened.

Now, let’s plan what’s happening next on the current move away from our newly achieved target:

We earlier highlighted the $100 level as a dual target:

It’s the falling 20 week EMA ($100.51) and a simple Round Number Target.

On the “Bear Trap” reversal up away from the $90.00 per share level, price surged strongly to $100.00.

At this point, we’re seeing buyers logically (and correctly) take profits (short-term trades) and aggressive bears step back into the downtrending stock at a key resistance target.

Here’s a clearer look at the Daily Chart:

In addition to the falling 50 week EMA and $100 “Round Number” Price Level, we see the 50% Fibonacci Retracement aligning just above $100.00 per share.

Aggressive traders had a low-risk, high-probability short-sell opportunity into this level, especially with last week’s “Spinning Top” candle into this level.

Now we’re seeing the price fall sharply “down away from” $100.00.

We’re on guard for a possible continuation lower toward the key $92.50 level for a full retracement.

Whether you’re trading this high-flying stock or not, this is a great educational example of how planning and real-time action align for profitable trading.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

It could be a good opportunity to go into buying mode, but obviously we need to make sure we have good money management in place to make it work out. I am currently trading with OctaFX broker and that’s where I am able to manage things nicely with their 50% bonus on deposit offer, it’s use able too, so that gives me boost as far money management is concern while there are no restrictions or unnecessary policy to trouble me either.