April 1 Big Reversal Update and Stock Scan

Today has been a heavy economic news day and the market is responding with higher volatility.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

From the monthly Jobs Report this morning to manufacturing data along with consumer sentiment, our initial downside gap turned into a large bullish surge off the 2,045 support target level.

Now, the index trades just shy of the 2,070(ish) prior high from Wednesday.

We’ll be trading between these range consolidation levels until we see a future breakout.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

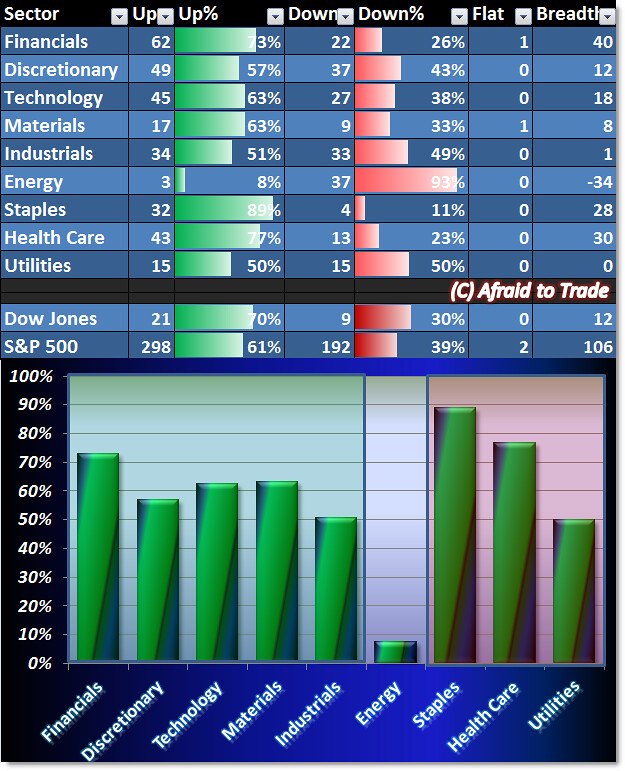

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

The Breadth (or money flow) Chart is roughly mixed with Staples being the strongest sector today.

Health Care is next which tilts the forecast bearishly as the defensive sectors are the strongest group today.

Energy is the weakest sector by far with 3 stocks trading positive on the session right now.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

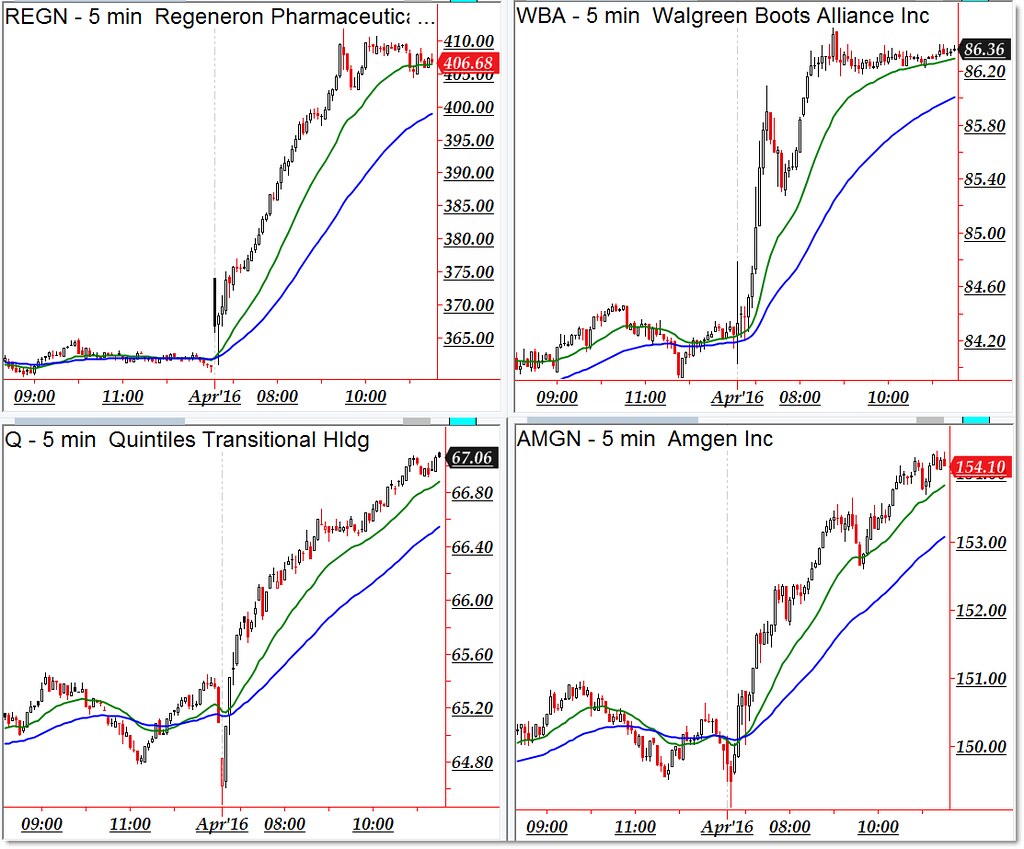

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Regeneron (REGN), Walgreen Boots (WBA), Quintiles (Q), and Amgen (AMGN)

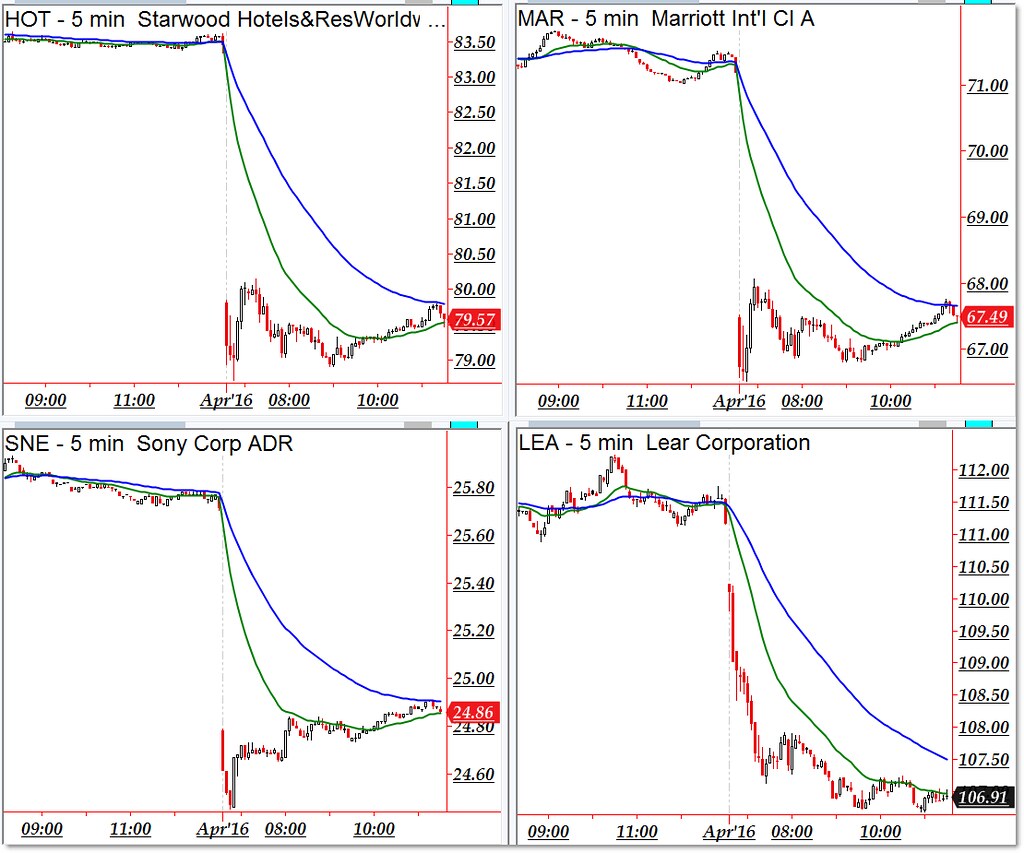

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Starwood Hotels (HOT), Marriott (MAR), Sone (SNE), and Lear Corp (LEA)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).