April 21 Gap Trap Surprise Market Update and Stock Scan

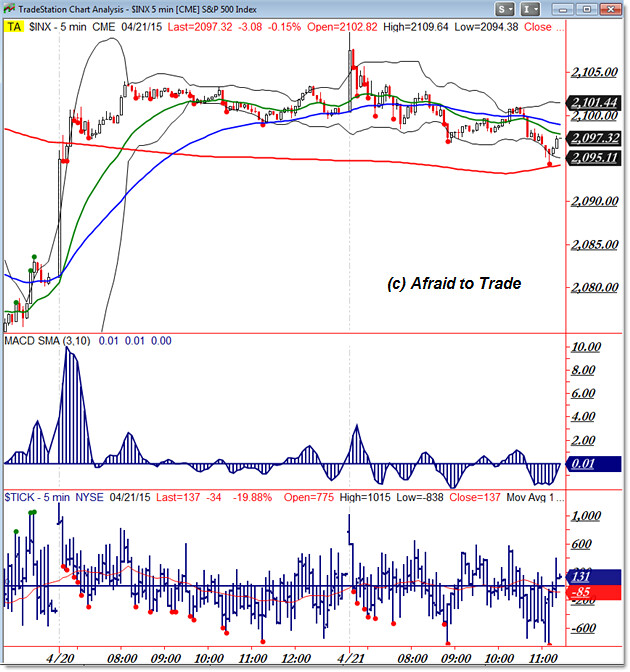

As we’ll see on the intraday chart, today’s session was a continuation of the sideways range that developed after Monday morning’s big upside gap.

Despite early morning bullish action in the futures, price retraced and has traded lower/sideways all day.

Let’s dive inside action and note key levels and the trending stocks of the bullish day:

Be sure to brush up on the “S&P 500 Range Planning” post for a broader perspective.

We’re still within the context of the sideways trading range mentioned earlier, though the morning action threatened a breakout.

The breakout failed and the bias will be to the downside, especially if price remains under the 2,100 pivot.

Use 2,100 as the intraday inflection point and don’t be surprised if price falls back into a familiar groove and falls down away from 2,100.

By the same logic, don’t be surprised if – like February – buyers intervene and thrust the market via a short-squeeze pathway to new highs.

Be prepared for either the “Range Continuation” or “Range Breakout” scenarios.

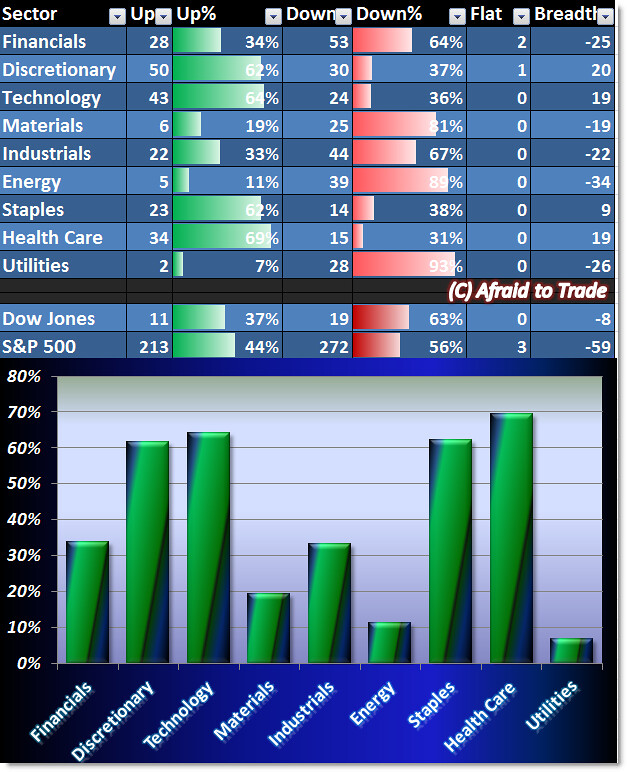

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

We have division in the ranks as four sectors are above the 50% line and five are beneath it.

The strongest cluster is in the Defensive names of Staples and Health Care… yet this traditionally bearish signal is offset by the bullish cluster in Discretionary and Technology.

Energy and Utilities lag the market today and should be avoided unless going short individual names.

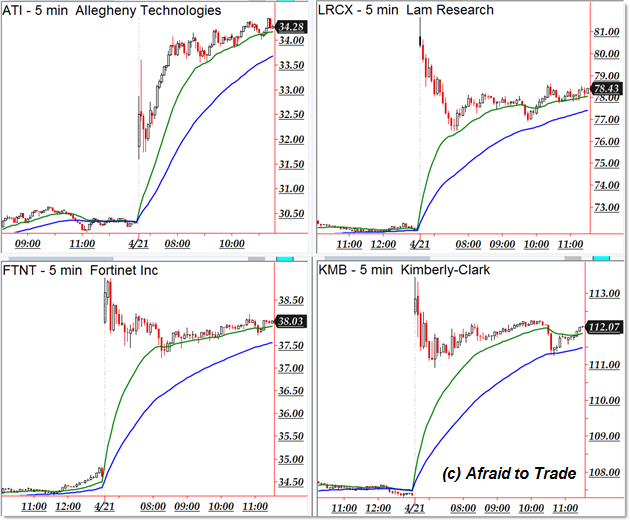

We have potential bullish trend continuation plays in the following stocks from our scan:

Allegheny (ATI), Lam Research (LRCX), Fortinet (FTNT), and Kimberly-Clark (KMB)

If you’re must be a bear on a bullish day, you can try these bearish/weak names:

Packaging (PKG), Harley Davidson (HOG), Travelers (TRV), and Hartford (HIG)

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Mostly I keep my self away when there is sideway trend, it is tough for me trading with that. I am a long term trader and with that I need to be certain and that is possible only with a clear trend but another advantage is OctaFX broker, it has superb swap free account, so I can do long term trading easier without having to lose much fees while there is no other commission so that makes everything really profitable for everyone.