April 21 Range Reference and Market Internals Update for SP500

What message are the Big Three Market Internals sending us as we challenge an upper ‘boundary’ or reference level of our ongoing S&P 500 Rectangle?

Let’s take a look – the message is clear but the outcome is never guaranteed:

As is always the case, we monitor Market Internals with price, particularly comparing price highs formed during an intraday trend with corresponding highs in the Internal Indicators.

We look for STRENGTH or a Kick-off in internals at the start (birth) of a new intraday trend and then monitor divergences or lower highs in internals as price carries forward in the new uptrend.

Divergences or non-confirmations indicate caution (take profits) at a minimum, and frequently precede a short-term trend reversal.

We’re balancing the odds of short-term trend continuation against the probability of a reversal.

Right now, with price into a key inflection level (1,870) as I’ve been highlighting to members, we see internals diverging (falling) with the price scraping against resistance.

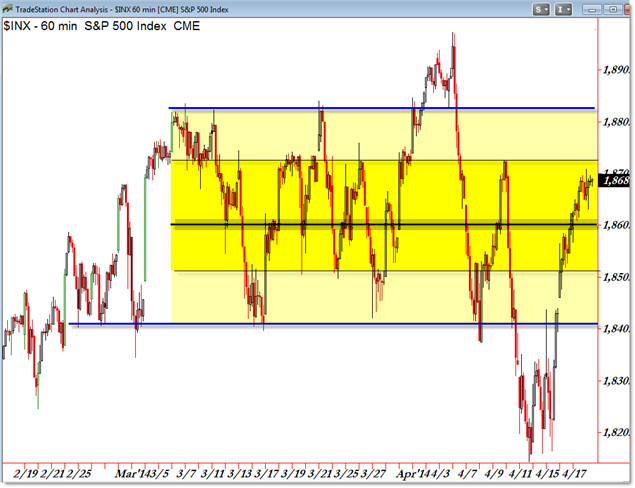

Here’s a clearer picture of the Value Area and Range Rectangle that continues in the S&P 500:

We have a Core Value Area (think “Magnet”) near the 1,860/1,865 level of a wider rectangle with external trendline boundaries into 1,840 and 1,881.

A smaller but important “internal” boundary level exists near 1,850 and our current inflection level of 1,870.

If we interlace the pictures, we see price trading into a known short-term resistance level as intraday divergences are present.

This suggests a shrot-term movemetn down against 1,870 back toward 1,860 or even 1,850, but as always, we as traders must be ready and willing to trade an alternate thesis breakout where price overrules divergences into resistance.

This alternate breakout play triggers above the 1,872 level and suggests an upward surge toward 1,880 (as short-sellers cover losses).

This logic is similar to the Biogen (BIIB) Swing Trade Planning post I published earlier this morning.

For now, focus your attention on 1,870 and the immediate reaction down or surprise breakthrough higher.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

2 Comments

Comments are closed.