August 13 Stock Scan and End of Day Market Update

Yesterday’s rally continued into today’s session though price fell shy of the full touch of 2,100.

What levels are we focusing on now? Let’s see!

First, be sure to view Monday’s “Thrilling, Non-Stop, Exciting Trading Range of 2015” for context.

After an initial – and logical – sell swing down against 2,090, price held support at the rising average and 2,080 level.

Buyers pushed the index above the 2,090 level on lengthy negative divergences ahead of a decline into the close.

Follow along with members for more precise daily planning, analysis, and education.

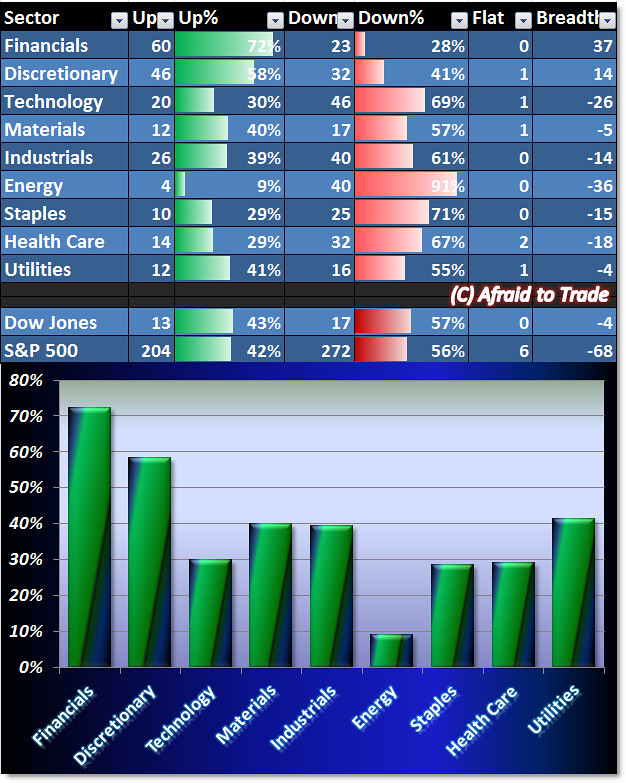

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

The picture from Breadth today is actually bullish!

Financials and Consumer Discretionary sectors were today’s leaders while the defensive group – Staples, Health Care, and Utilities – were among today’s weakest sectors.

However, the weakest sector today was actually Energy which has been volatile lately.

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Berry Plastics (BERY), McDonald’s (MCD), Nucor (NUE), and Cooper Tire (CTB)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Smucker’s (SJM), Westlake (WLK), Lexmark (LXK), and Caterpillar (CAT)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

The scenes are extremely bullish from this chart, I believe it is going to continue for next few months, but in Forex we all know it does not take long for things to change up, so we need to be very careful. I am very much fortunate that I have got rebate option open with OctaFX broker, it has over 50 currency pair to select from and getting 50% return according to the paid spread, so that’s why it is so good for me or any trader to use this.