August 18 Breadth and Stock Scan Market Update

Our mid-day update takes place on yet another bullish trend day higher as price breaks through resistance toward the prior highs, as I’ve been highlighting recently.

For our S&P 500 update, see this morning’s post “On and Up to New Highs for the S&P 500” along with the recent “Breakout from a Repeat Pattern” post.

In sum, the market is doing exactly what it should be doing in order to complete a “Repeat Pattern.”

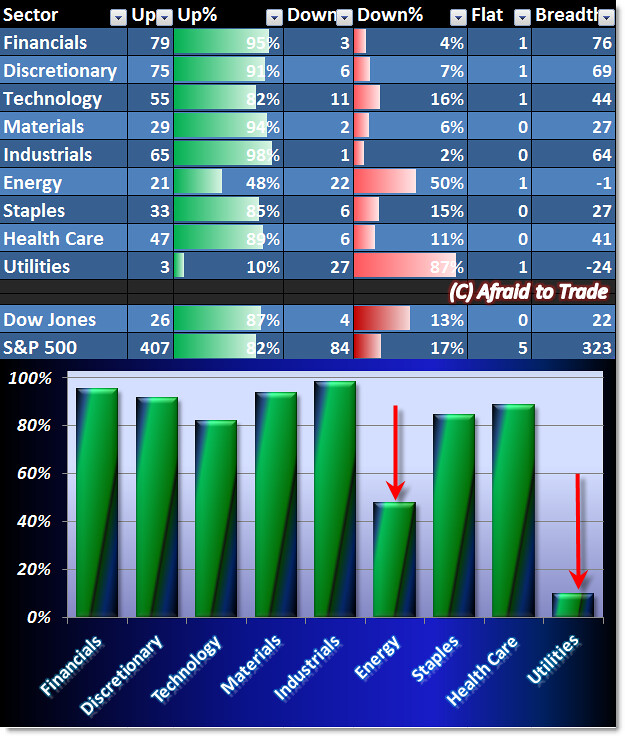

To further put the odds in the Bullish Camp, let’s take a look at today’s strong Sector Breadth Chart:

Unlike Friday’s chart, we see strong Sector Bullishness across the board – underscored by the dismal performance of Utilities today (only 1 of 27 S&P 500 Utility stocks are positive right now).

Our other relative strength laggard is Energy while all other sectors – Bullish along with the defensive Staples – enjoy strong sector performance.

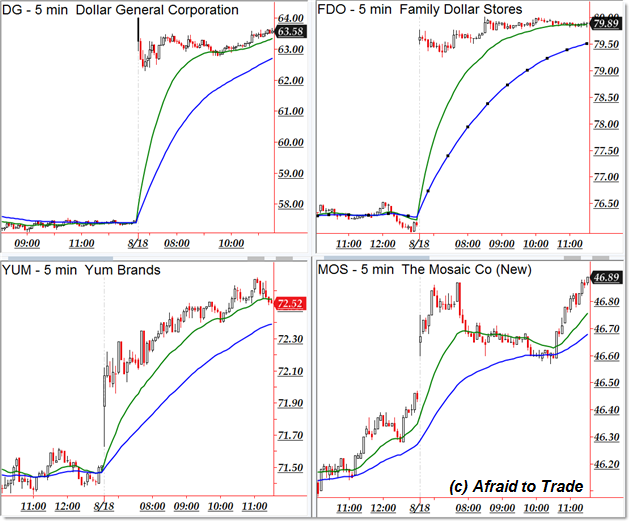

If you’re looking to play trend continuation trades, focus on the following names which could trend higher into the close:

Dollar General (DG), Family Dollar (FDO – both in merger news), Yum Brands (YUM), and Mosaic Co (MOS).

If you can’t resist fighting the tide of money into the market, focus on these potential bearish sale candidates:

Conoco Phillips (COP), Monster Beverage (MNST – retracing after a strong Friday), Loews (L), and Microchip (MCHP).

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).