August 21 Stock Market Update with Trending Stock Scan

As we continue yet another trend day to the upside, let’s highlight the price action, sector strength, and identify the strongest trending stocks so far at mid-day in the bullish session.

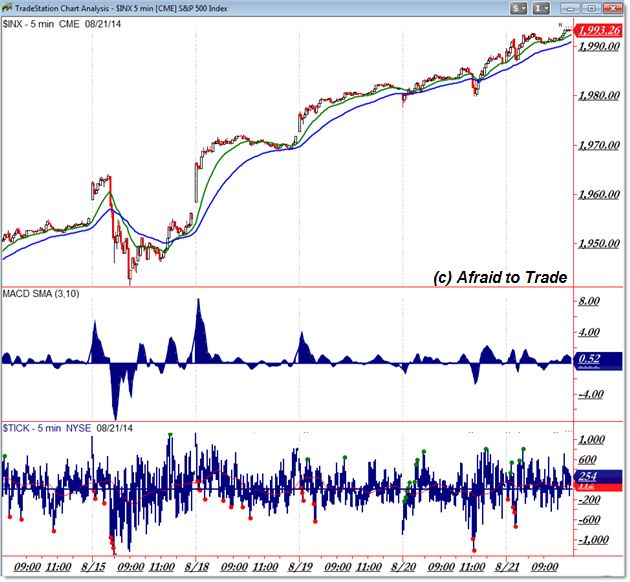

We’ll start with the S&P 500:

I’ll let the chart speak for itself but will again reference the series of posts I wrote leading to this point:

Studying the “Repeat Pattern” that Forecasts New Highs for the S&P 500 (achieved!)

“Onwards and Upwards to New Highs for the S&P 500?

Planning a Breakout (from a Repeat Pattern) in the S&P 500

S&P 500 “Breaks on Through to the Other Side

Decision Point for the Dow Jones

We’ll be carefully watching news for the rest of the day as the indexes trade through new highs (the S&P 500 seems to be pulled higher like a magnet to 2,000… or perhaps a moth to a flame).

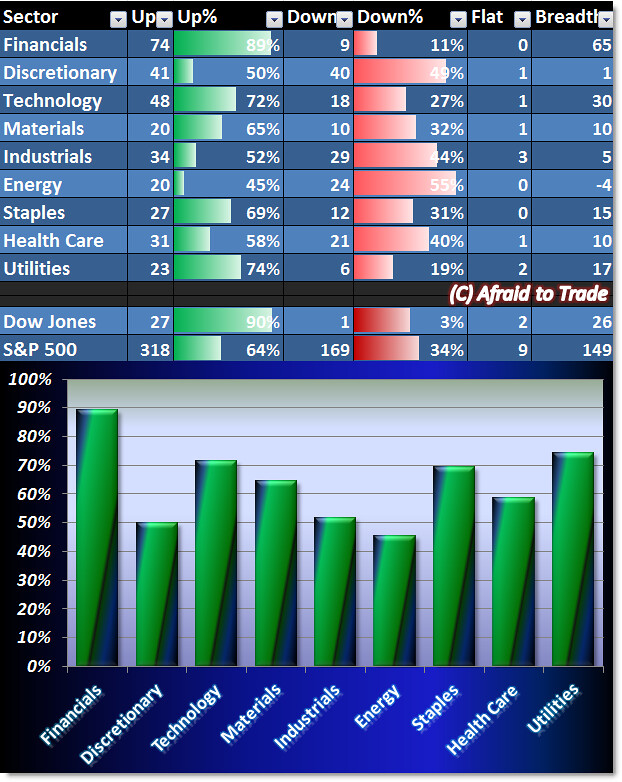

Sector Breadth – as you might suspect – reflects bullish money flow:

Our strongest sector today is the Financials (which was confirmed when multiple financial sectors stocks appeared in our screen) while the weakest sector is Energy.

Discretionary is the second weakest sector while Utilities turns in the second strongest performance today.

We’ll focus our attention on potential bullish trend day candidates into the close:

eBay (EBAY), Amphenol (APH), M&T Bank (MTB), SunTrust Banks (STI) along with other regional banks.

For those who ready themselves for reversals, here are potential bearish downtrend continuity candidates:

Wynn Resorts (WYNN), Whole Foods Market (WFM), Norfolk Southern (NSC), and Google (GOOG).

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).