Big Bang Jan 4 Market Update and Moving Stock Scan

Welcome to 2016! The bears ruled the opening session of the new year on concerns from China’s stock market.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

Take a moment to review the morning post for additional level and target (trade) planning for the S&P 500.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

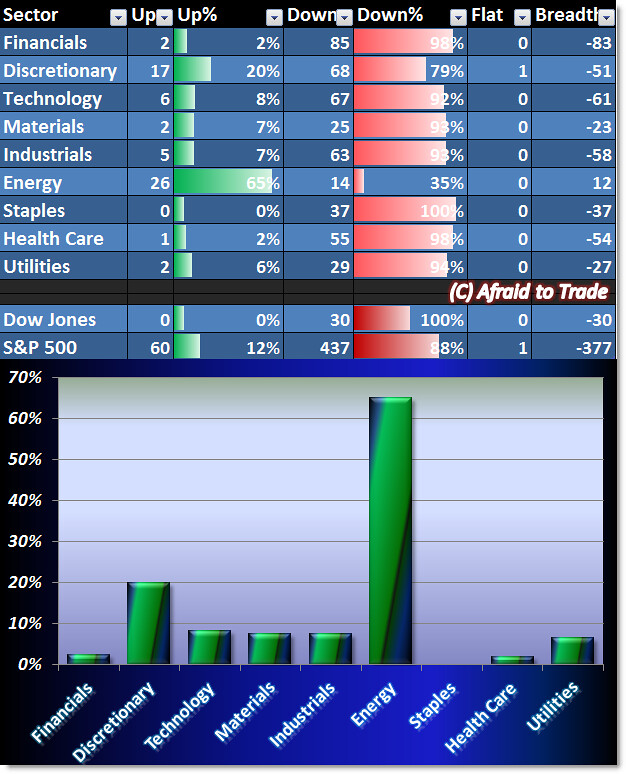

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

100% of the Dow Jones stocks and 88% of the S&P 500 stocks are negative at the moment.

Energy is the stand-out sector today while all other sectors are strongly negative/bearish.

In this type of money flow (defensive) environment, capital preservation is the key, along with aggressive short-selling.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

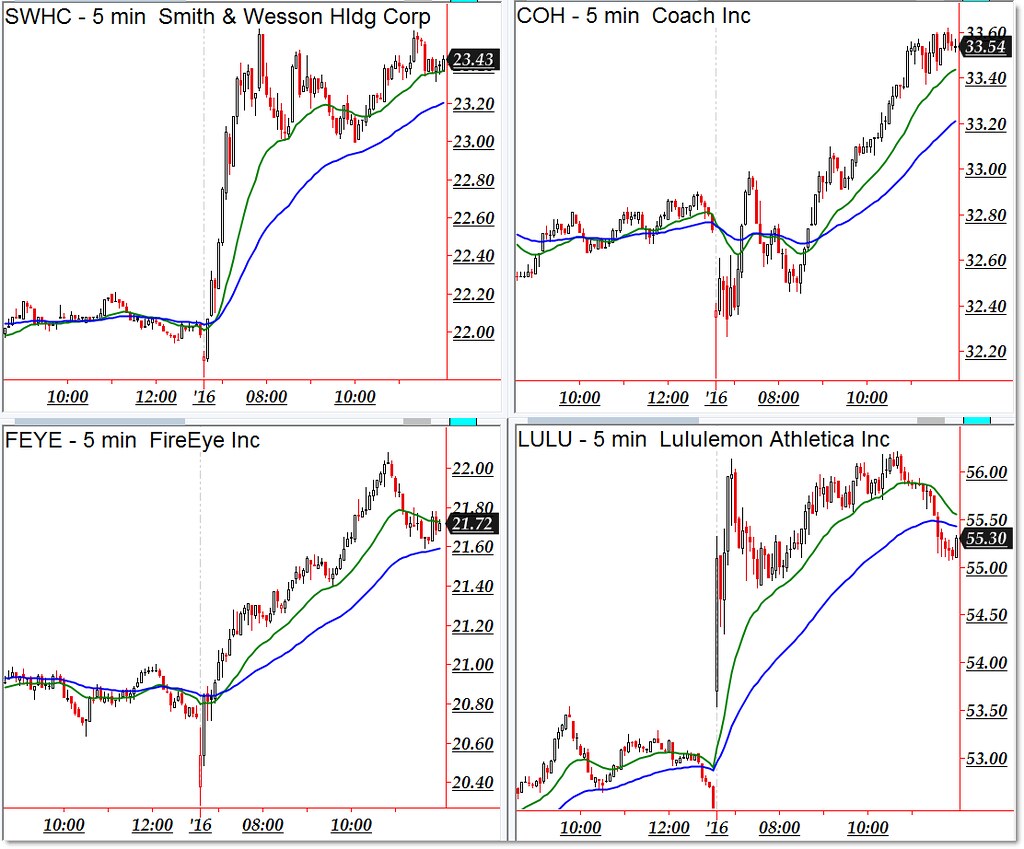

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Smith and Wesson (SWHC), Coach (COH), FireEye (FEYE), and Lululemon (LULU)

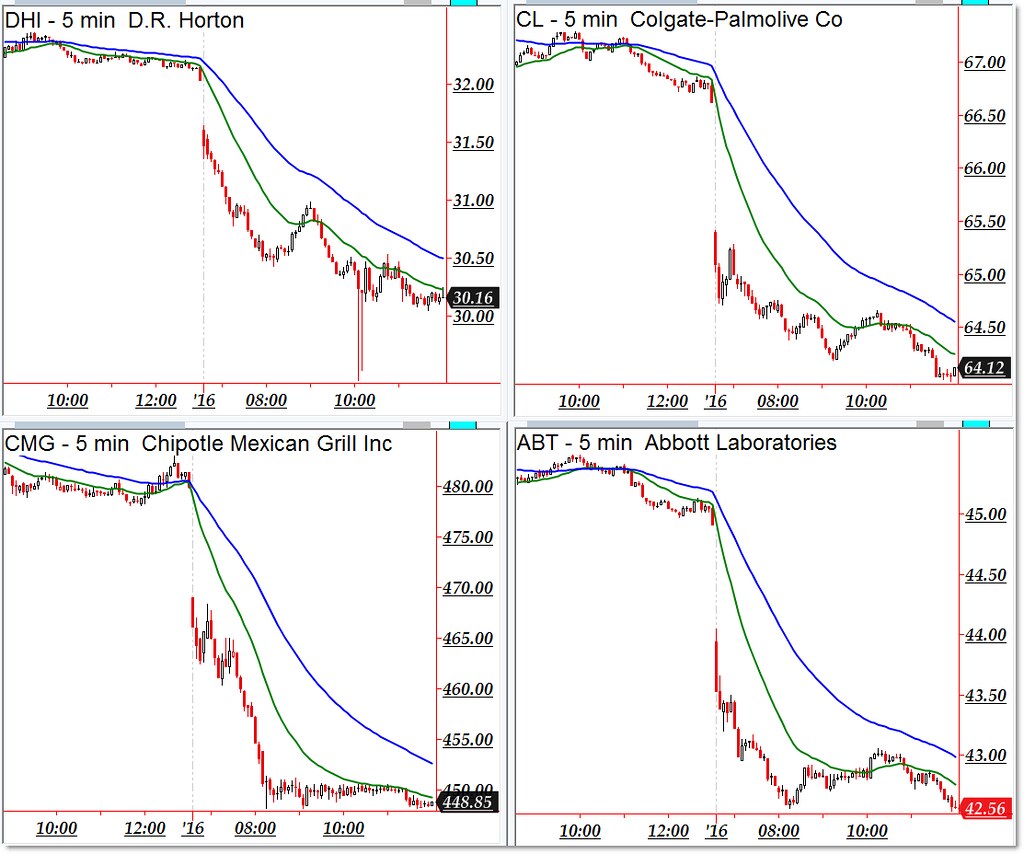

Bearish downtrending candidates include the following stocks from our “weakness” scan:

DR Horton (DHI), Colgate-Palmolive (CL), Chipotle (CMG), Abbott Labs (ABT)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Opening part of the day is very crucial, as it can easily be the trend setter, but again one should always be ready since anything is possible and one who calculates all possibilities is one who wins often. I am not the master in this sort of stuff, but given I have solid support with OctaFX broker especially with their low spreads starting from 0.1 pips, it helps me a lot to catch the trend and even if I don’t get it right, I can bail myself out rather quickly due to such conditions.