Bounce Back Bullish Market Update and Scan for April 20

And we’re back! Back to the highs of Friday’s activity that is – and should we be surprised?

Price traded down to a key support level, formed positive divergences and power-rallied back higher this morning, almost as if nothing at all happened Friday.

This is a pattern of the current undeniable bull market that has repeated many times.

Let’s dive inside action and note key levels and the trending stocks of the bullish day:

Be sure to brush up on the “S&P 500 Range Planning” post for a broader perspective.

More divergences, more reversals off higher timeframe support or resistance levels.

Today’s session took the price back above 2,100 into the mini-range between 2,100 and 2,105.

The market remains super-bullish above 2,105 and cautious on a break back under 2,100.

Note the negative divergences that suggest a possible turn lower back under 2,100 but wait for the market to tip its hand before jumping back to the bearish side of this ongoing bull market.

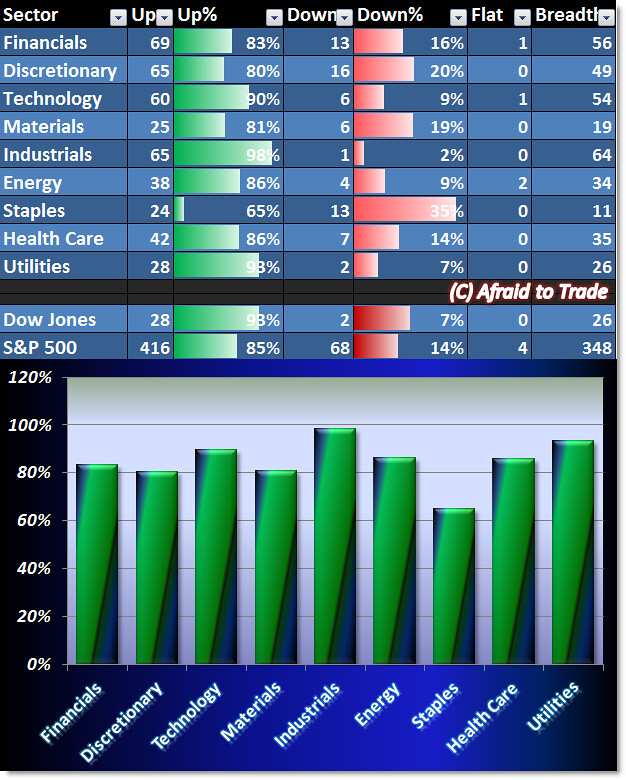

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

All sectors – except defensive Consumer Staples – are strongly positive today which underscores the bullish money flow surging back into the market.

On days like this, individual stock selection (perfection in scanning) is less important than just getting into the river of money flow into the market – find a stock in a strong sector and manage risk along the way. Don’t waste time finding the perfect stock on days like this.

We have potential bullish trend continuation plays in the following stocks from our scan:

Hasbro (HAS), Kansas City (KSU), CSX, and CH Robinson (CHRW)

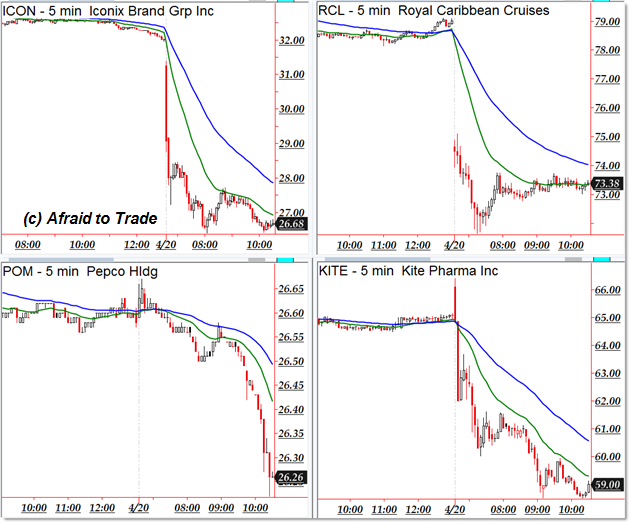

If you’re must be a bear on a bullish day, you can try these bearish/weak names:

Iconix (ICON), Royal Caribbean (RCL), Pepco (POM), and Kite Pharma (KITE)

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Frankly speaking this is more of expected thing after extended bearish movement now we are witnessing a major correction, but the question is how long will it last? I personally believe that we might soon see shift in the trend and that’s why I am in short while it’s no issue to keep the trade on as long as I wish because of swap free account which is offered by OctaFX broker, it’s one of the biggest brokerage companies in the world.