Breaking Range Market Update and Stock Scan April 26

We’re seeing a bullish reversal swing laboriously developing in the S&P 500.

Will it hold? And what stocks are our big trenders today?

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

A “Rounded Reversal” style intraday price pattern is developing off the 2,075 (2,080) index target.

Right now the S&P 500 remains within our NEUTRAL ZONE between 2,075 and 2,100 as seen above.

A Symmetrical Triangle developed during today’s action with the midpoint resting just under 2,090.

Look to play a breakdown short away from 2,090 or else an impulsive breakout back toward 2,100 if above it.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

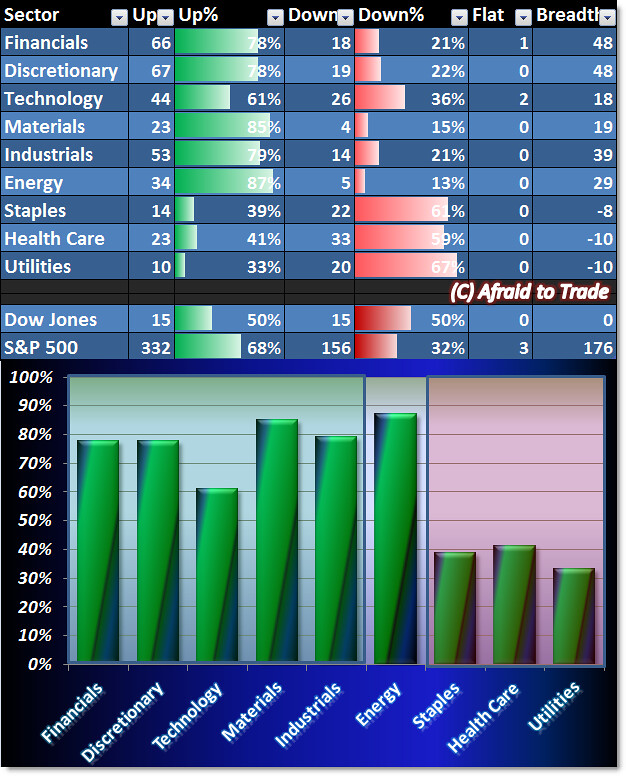

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Despite the Triangle Price Pattern, we’re actually seeing somewhat bullish money flow.

Our strongest sectors are all the “Risk-On” groups while the weakest of the day are the Staples, Health Care, and Utilities (“Risk Off” groups).

It could suggest additional upside action in the bullish swing pathway seen above.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

McGraw-Hill (MHFI), Pioneer (PXD), PACCAR (PCAR), and CarMax (KMX)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Wyndham Worldwide (WYN), Canadian National (CNI), JD.com (JD), and Whirlpool Corp (WHR)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

I think there is a decent opportunity here to get into the trade, but we need to make the right entry in order to benefit, it’s great to have blogs like these with such deadly accurate analysis and updates, I always follow this especially for long term trading that’s easier due to OctaFX broker that I use, as they provide me swap free account and saves me from paying overnight charges, so pretty cool that is and really helps in trading.