Bullish Sector Breadth with Caution and Trending Stock Scan for April 14

While the broader US Stock Market rallies sharply off an inflection low today, the Sector Breadth performance sends caution signals despite broader bullish price action.

Let’s see what’s going on under the market and identify our key trending stocks for today’s session.

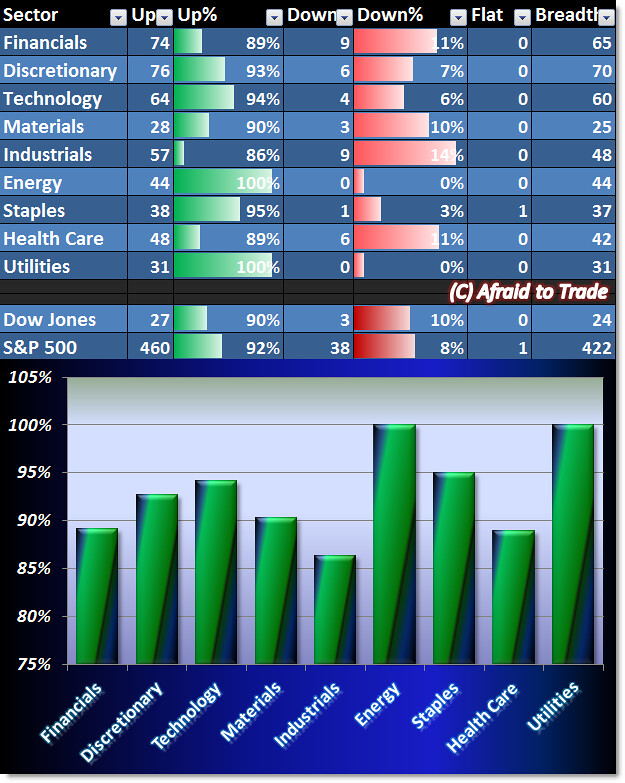

Despite across the board bullish price action where 90% of Dow Jones and S&P 500 stocks are higher in today’s session, take a close look at the bars in the sector performance grid.

As we’ve seen in prior “bearish sector money flow” updates such as April 11th, April 10th, and April 7th, we’re seeing the strongest sector performance – 100% of stocks in the sector positive right now – in Utilities ($XLU) and Energy ($XLE).

While the difference is small, the fact remains that Industrials ($XLI) and Financials ($XLF) join Health Care ($XLV) for the “least strong” sectors of today.

Again, we’re not seeing a huge non-confirmation, but money continues to concentrate itself in the defensive sectors, even on a day like today.

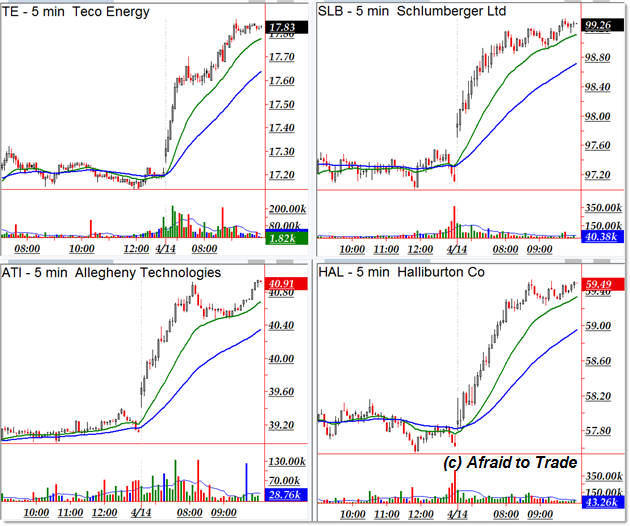

Speaking of bullish price action, here are potential bullish “Trend Day Continuation” candidates:

Teco Energy (TE), Slumberger (SLB), Allegheny Technologies (ATI which returns to our list), and Halliburton (HAL).

Our potential bearish trend day candidates include the following:

Carnival Corp (CCL), Pitney Boles (PBI), Intuitive Surgical (ISRG which also reappears, as I covered in an earlier educational blog post), and Bristol-Myers Squibb (BMY).

Unless we see another stellar intraday reversal, continue focusing on the relative weakness names and shorting them as the sell-off continues.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

2 Comments

Comments are closed.