Charting the Breakdown and Key Level in the CRB Index

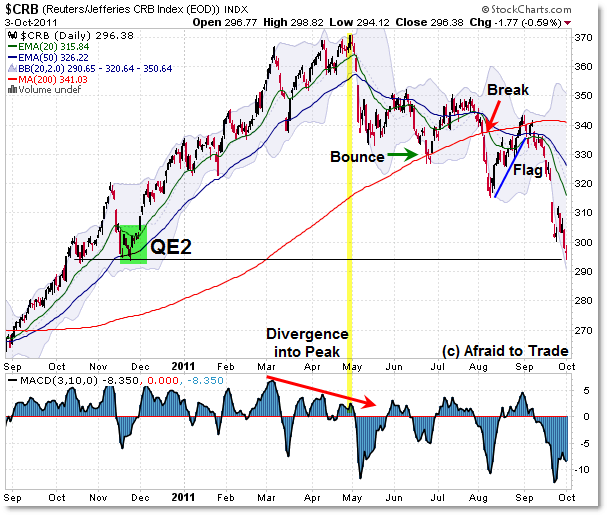

Commodities – along with equities – have fallen sharply since their respective May 2011 market peaks.

Let’s take a look at the breakdown in the CRB (Commodity) Index and note the critical confluence reference support level upon which the index sits currently.

First, let’s start with the May peak of 370. I showed previously that there was a “Three Push” price pattern accompanied by a corresponding negative momentum divergence, which was a major caution sign for the index.

Price then broke both the 20 and 50 day rising EMAs, resulting in a new price and momentum low (a “Kick-off” Early Reversal Signal).

Price stagnated between 330 and 350 for the next few months, though price structure took on a bearish pattern which confirmed an official trend reversal on the break under 320 in August.

The August breakdown also triggered a close under the rising 200 day SMA, often a “Line in the Sand” marker between bull and bear markets (at least in simplest terms).

In late September, Commodities in general collapsed towards the current 300 target after triggering a “Bear Flag” or breakdown reversal set-up into 340 (the underside of the 200d SMA reference level).

For reference, this is a good example of how a chart-based Trend Reversal develops and is confirmed by non-correlated indicators (“Three Push” price pattern, negative momentum divergences, EMA breakdowns along with bearish cross-overs, new momentum low “Kick-off” signal, break under 200d SMA, etc).

I’ll be discussing Trend Reversals in much more detail during two upcoming presentations:

“Designed by Traders: Trading Trend Reversals“ October 12, 3:30 CST

How to Spot and Trade Trend Days –(when to expect them, how to adapt your tactics/trades to them) – at the upcoming Las Vegas Traders Expo in November.

At present, the index trades at the same level as when the Federal Reserve initiated its “Inflation-Creation” program known as QE2 (Quantitative Easing).

That’s important to know as we turn now to the weekly chart to see why the 300 level is a very important index reference level:

While you can spot other lessons in the chart above (the interesting correlation between QE1 and QE2 on the CRB Index, negative divergences and reversals into January 2010 and May 2011), let’s focus our attention simply on the two Fibonacci Retracement grids overlapping at the 300 level.

The RED Fibonacci Grid is the “Bear Market” retracement up, starting with the 2009 low and moving back to the 2008 peak.

The GREEN Fibonacci Grid is the “Bull Market” retracement down, starting with the 2011 high and moving back to the 2009 low.

You can also see that the 2011 high into 370 (and the negative daily divergences) developed into the 61.8% Fibonacci Retracement of the Bear Market – very interesting.

What’s most important right now is the double-confluence just above 300:

The 38.2% “Bull Market” retracement at 306 and also ironically the 38.2% “Bear Market” retracement at 304.

To throw another classic indicator into the mix, the flat 200 week SMA resides at 306.50.

As you can see above, price is nipping under this higher timeframe confluence area which isn’t a good sign for buyers.

In the meantime, watch the reference support from the November 2010 “QE2” low near 295 along with the weekly confluence above 300.

Just like in stocks, a failure to hold their critical current support reference levels (see prior posts on the levels to watch in all stock market indexes), a breakdown here suggests lower prices will be seen in both stocks and commodities, so keep all these important levels in mind as you trade this (and next) week.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available!

I relate that Commodities, DBC, were inflated by Ben Bernanke’s QE2, and then suffered quantitative easing exhaustion in May, and then debt deflation, that is currency deflation, in August and September as commodity currencies, CCX, fell lower. The failure of commodities reflects failure of the seigniorage of US Federal Reserve ZIRP to maintain growth, and the termination of the Milton Friedman Free To Choose Floating Currency Regime. Currencies, Commodities, and Stocks are all falling lower into the Pit of Financial Abandon, as Kondratieff Winter bears down upon humanity. The Age of Leverage that came from the securitization of debt and carry trade investing and produced prosperity for many is over. The Age of Deleverage has arrived with the failure of the world central banks to provide seigniorage as is seen in world government bonds, BWX, falling lower, and the failure of carry trade investing seen in the Optimized Carry ETN, ICI, falling lower.

link to your trading trend reversals is not working

Thank you for letting me know, Eric. It looks like the entire TraderKingdom site is temporarily offline/down at the moment, not just the link.

Thank you for letting me know, Eric.

It looks like the entire Trader Kingdom website is down temporarily perhaps for maintenance, not just the link.