China Shanghai Index Enters Bear Market

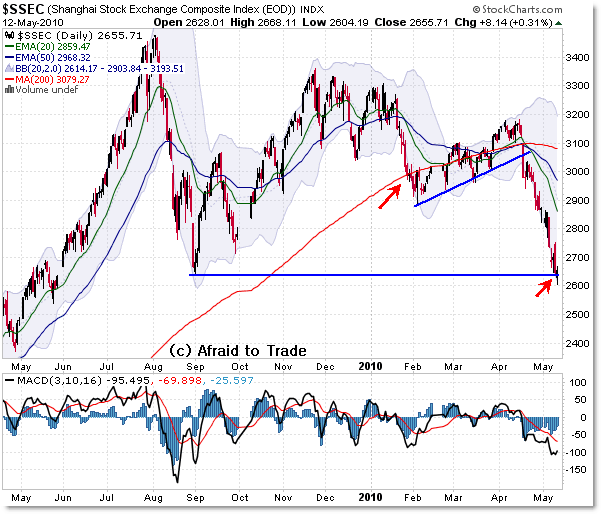

Depending on how you define it, China’s Shanghai Stock Exchange Composite Index has entered an officially defined “Bear Market” – according to the charts – using three objective measures.

Let’s see them:

One of the goals of charting stock market indexes is to assess the trend and make assumptions from there. That includes distinguishing a trend between up and down (or distinguishing between bull and bear markets).

Let’s look at three chart-specific methods analysts popularly use to make the distinction:

1. Above/Below the 200 day Simple Moving Average

This is the ‘shortcut’ way to separate a market between bull and bear, and is the preferred method for scanning.

If price closes (and remains) above the 200 day SMA, then it is in a bull market.

If under the 200 day SMA, then it is in a bear market.

The $SSEC closed under the 200 day SMA in early February, bounced around this level through April, then broke and fell sharply under it in mid-April. Check.

2. Twenty-Percent Threshold

There’s a popular saying that when a market declines 20% from a recent peak, then it has entered official “Bear Market” territory.

The index peaked near 3,500 in August 2009 (compared with the US S&P 500 which peaked so far in April 2010) and now has fallen 25% to the 2,600 index level. Check.

3. Pure Price Method

This is a bit more complicated and takes some charting skills. If an uptrend is defined as “higher swing highs and higher swing lows,” then a downtrend is equally defined as “lower swing highs and lower swing lows.”

If we think of larger swings, we would classify the August 3,500 swing as a ‘higher high’, then the September 2009 swing as a ‘higher low,’ but that trend began to change with November 2009’s “lower high” of 3,350.

Using this method, the official “lower low” just hit this week as price dipped under the August 2009 swing low at 2,650. This week’s breakdown is that official “lower low” that changes the trend officially. Check.

What now?

Official declarations are not magic – and the market will not suddenly plunge because it has met three main criteria of a “Bear Market.”

However, you should factor this into your international market analysis and how a slowdown or bear market in China might affect global economies, especially if China doesn’t continue to fill the role of “rapidly expanding economy” that analysts think it is.

Keep an eye on China’s market for any new developments.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

One Comment

Comments are closed.