Disney DIS Surprises with New Highs but Watch the Trap

Disney (DIS) – one of the strongest trending names in the Dow Jones Index – reported strong earnings and revenue this morning, gapping the stock to new all-time highs.

However, as soon as the new high popped, sellers crushed the stock back under the breakout level.

Let’s highlight the gap, weekly trend (it’s stellar), and the current reference levels for traders.

Note the strong uptrend as seen by rising moving averages and the series of higher price highs and lows.

In an uptrend, we tend to look to the rising 20 or 50 day EMAs (Exponential Moving Averages) for support pivots and thus spots to buy shares (or add to positions) as the uptrend continues.

Disney has been accelerating to the upside since the April low and today’s gap completes a type of small exponential movement higher.

First, we’ll focus attention TODAY on the $110.00 per share level which is a round-number breakout spot.

Ultimately, Disney shares remain bullish on the Daily Chart as long as they remain above the rising 20 day EMA currently positioned just under $109.00 per share.

We’d prefer to see a support-bounce up off the $110 level but we’ll use $109 as the bull/bear pivot.

Again, it’s preferable to enter positions on pullbacks to rising moving averages – called “retracements.”

The alternate way to enter a strongly trending stock is on breakouts above resistance like the example of February with the prior gap and price surge above $95.00 per share.

With those levels in focus, let’s shift to the Weekly Chart for additional perspective:

If you had to paint a visual picture of trend perfection, Disney (DIS) would be it.

Note the persistent, steady trend and multiple bounces (pivots) up off the rising 20 week EMA (green).

Again, it’s safer to put on positions into support in a rising trend like this, not breakouts like we’re seeing now.

The trap scenario is one we’re seeing where price impulses up on good earnings but sellers – not buyers – push the price lower toward a support level (like $110 or $109).

Last week’s candle was a hanging man into $110 and so far – two days in – this week’s incomplete candle is a shooting star on negative momentum divergences.

Let Disney shake-out a bit instead of rushing into buy just because earnings were better than expected.

Focus on the $110.00 and $109.00 per share levels and in the event these fail, look to the weekly $105.00 target.

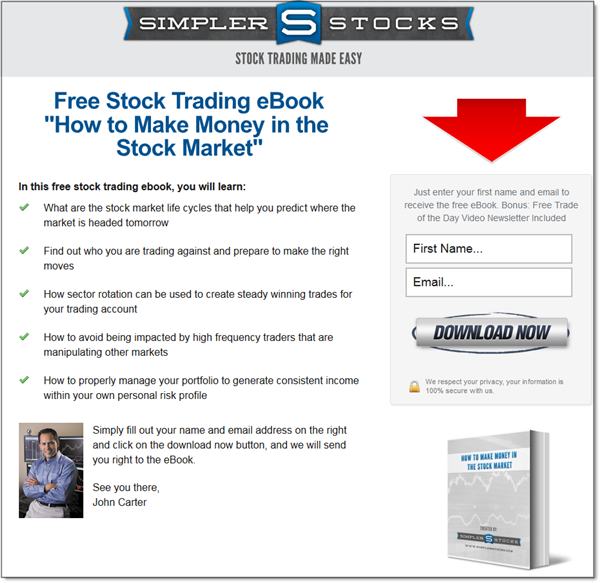

Visit the Simpler Stocks intro webpage for a new eBook from my colleague John Carter:

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

I don’t prefer to trade on these stuff, I believe in simply currency pair trading, it’s highly profitable and I don’t need to get into this complicated mode, I am also very lucky to be working with OctaFX broker, as they have spread of 0.2 pips for all major pairs and another massive advantage is that they have over 50 currency pairs to work with, it is a lot of pairs to choose from and that’s why I really enjoy working with them.