Emini Breaking Through our Fibonacci Grid Update

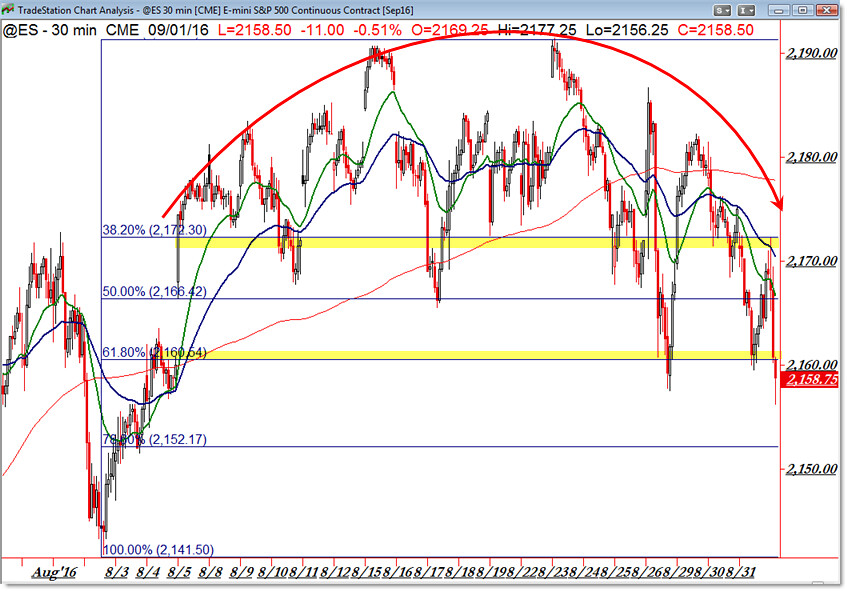

We’re still within the trading range and price is still reacting to our short-term @ES Fibonacci Grid.

Here’s today’s updated Fibonacci and Emini (@ES) trading levels for your plans and trades:

Here’s a reference guide of how to use and trade from these morning updates.

Here’s a direct quote from last night’s short-term strategy planning for members:

It’s possible that we’re now seeing a ROUNDED REVERSAL or ROUNDED ARC pattern take place in the intraday frame.

If so, the next eventual move would be a swing down away from (under) the 2,160 level toward 2,145 in the @ES.

Be on guard for this bearish development.

At the moment, that’s exactly what’s happening with the current rejection (reversal) at our 2,172 target and now breakdown under 2,160 as planned.

Want these levels and additional strategy planning in advance each evening?

Get these levels in advance with in-depth planning and trading opportunities by joining the Daily Membership.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Trading in range is always beneficial especially for scalpers, but we need to be very wise and careful with how we work out everything. I am trading with proper planning and good money management which is helped by OctaFX broker and their 50% bonus on deposit scheme, it’s top class because of been use able too, so that’s why I am able to perform so nicely and that’s how I am able to achieve good results without much trouble at all.