Feb 13 Bullish Breakout and Trending Stock Scan

As logically expected and as I highlighted to members last night, stocks continued their short-squeeze directed creep higher, trading just shy of the 2,100 round number level.

We’ve come down from divergences so far but let’s plan the rest of the session.

We’ll update our key levels, highlight the divergence, and of course note trending stocks today:

Let’s start with an update from the prior update on the current range and breakout targeting for the S&P 500.

It took about a month to occur, but price FINALLY managed to break above the upper resistance line near 2,070.

This instantly triggered a short-squeeze (short-sellers taking their stop-losses) at the same time buyers (bulls) added to existing positions or put on new bullish breakout positions.

Today’s action continued what began yesterday as strength carried over into today’s session.

The key focal point is 2,095 (the high) and 2,090 (where we are currently).

The divergence doesn’t bode well for buyers, but assume trend day continuity UNTIL price breaks under the rising 50 EMA (5-min chart above).

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Unlike yesterday when breadth was across the board bullish, today’s reading is muted and neutral.

First, Financials (and Staples) are underperforming while Utilities once again shows almost NO stocks positive.

The strongest sector is Energy followed by a group of 70% performers in the Offensive Sector Grouping.

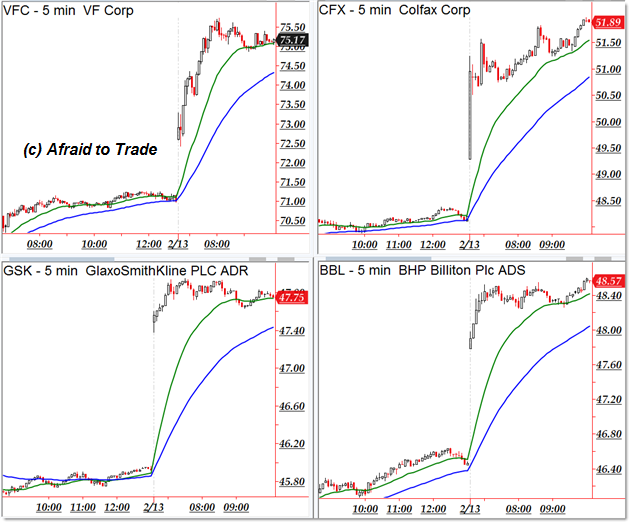

We have potential bullish trend continuation plays in the following stocks from our scan:

VF Corp (VFC), Colfax (CFX), GlaxoSmithKline (GSK), BHP Billiton (BBL).

Potential downtrending candidates exist in stocks showing relative weakness today:

DaVita HealthCare (DVA), PG&E (PCG), DTE Energy (DTE), and Ambarella (AMBA).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Breakout is a big signal that we can get in the market to collect profits at the same time but it’s not necessary that’s it’s real as there are many times where a fake breakout appears and that can be seriously dangerous for newbies who trade without management so we have to be very careful that we don’t trade if we don’t have right money management. I trade with strict plans and thanks to OctaFX broker with their low spread of just 0.2 pips and 50% bonus on deposit I am able to do planning so much better.

We got to be careful when it comes to Stocks since the investment required is so high one mistake can be disaster. I appreciate this lovely place (blog) for helping us out regularly, I believe we can gain so much from it while another great benefit for me is my broker OctaFX, it’s an equally good broker and brings loads of benefits whether it’s through conditions such as low spreads, high leverage or if it’s with their deposit bonus which is up to 50%.