Feb 19 Weak High Market Update and Daily Stock Scan

Surprisingly, the weak new price highs continued with another stab at the upper level again today, though bears were there to halt the market into resistance again.

The negative divergences still flash a big caution sign as price initially moves down away from this target.

We’ll update our key levels, highlight the divergence, and of course note trending stocks today:

After the breakout above 2,060’s rectangle resistance target, a powerful short-squeeze logically took the market to new highs into 2,100.

Today’s session saw potentially one more last-gasp rally at the new highs ahead of a reversal, but until we see price under 2,090 we’ll simply have to be cautious bulls and morph into aggressive bulls on a clean breakout higher above 2,105 or higher.

Right now, focus on the 2,095 to 2,105 simple range reference pivot points for planning trades.

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Unlike yesterday’s Bearish Sector Breadth, today’s session flashes a big bullish signal.

The strongest performance appears in the Offensive/Bullish Sectors like Discretionary and Technology while the weakest sectors today are the defensive names of Staples, Health Care, and Utilities.

If anything, this should give us pause and prepare plans to play a possible bullish breakout higher if it occurs.

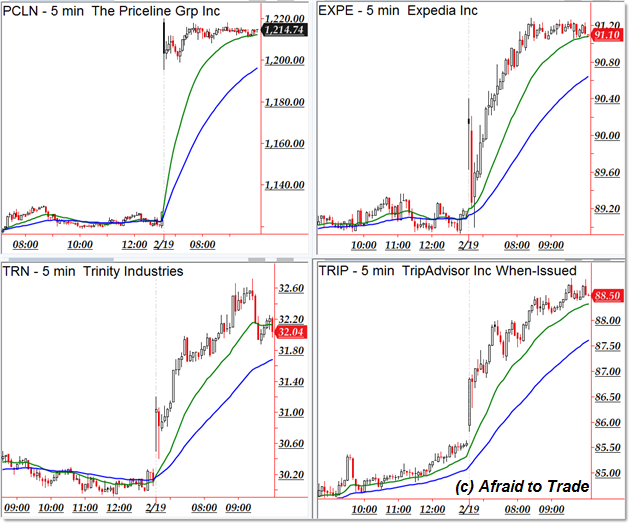

We have potential bullish trend continuation plays in the following stocks from our scan:

Priceline (PCLN), Expedia (EXPE), Trinity (TRN), TripAdvisor (TRIP)

Potential downtrending candidates exist in stocks showing relative weakness today:

Lasalle (LHO), Host Hotels (HST), Wal-Mart (WMT), and ProLogis (PLD)

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

It’s superb to be updated about the market on consistent basis and this site is perfect for this as I always get up to date with latest news and all that. I prefer trading with OctaFX broker and there is also a very similar system which we can rely upon so having 2 great sources is simply unbelievable and has really made me career stable as now I am fully aware of all the possibilities and that makes it very easy for me to succeed.