Feb 6 Reversal Market Update and Bull Bear Stock Scan

Markets are never boring! That’s for sure.

What started as a strong, bullish session has now reversed – from negative divergences – to a Rounded Reversal.

Let’s update our key levels, highlight the divergence, and of course note trending stocks today:

On the Unemployment Report, stocks started the session trending higher on a short-squeeze but ended the rally just above the 2,070 level on a lengthy negative Market Internal Divergence.

The afternoon shatter of the 2,070 level set in motion a sell swing and reversal down to create (so far) a Rounded Reversal pattern all the way under the opening price.

The short-term level to watch is 2,060/2,055 which puts us back in the consolidation level of yesterday’s session.

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Breadth rapidly turned negative on the reversal, shifting from a positive stance to the current negative one.

Only one sector – Financials – is positive today (above the 50% Breadth level) and all others are underwater.

The Utilities Sector has no stocks at all trading positive today – which is strange on a bearish session.

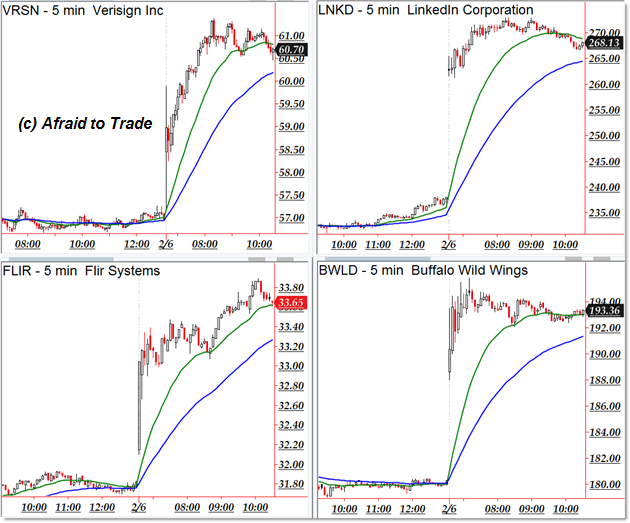

We have potential bullish trend continuation plays in the following stocks from our scan:

If the market holds support, look to play strength in Verisign (VRSN), Linked-In (LNKD), FLIR, and BWLD.

Potential downtrending candidates exist in stocks showing relative weakness today:

YELP, Brixmor Property (BRX), TripAdvisor (TRIP), and Scana Corp (SCG)

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Currently the market looks completely bearish and there is no reversal expected especially with the NFP coming in few days it is only going to get deep here. I am trading with OctaFX broker and I know everything because of them. They have got the most trustable analysis system which hardly goes wrong. It is provided by highly qualified team of experts and so far following this I have double my initial capital within 2 months and to go with been completely free is just outstanding!

It’s always important to set proper plans in place or else we will often find our self in trouble. I am glad to be active with this blog, it makes me understand things so very well and the plus point for me is my broker OctaFX since with them, I gain massive cash back which is up to 15 dollars per lot size trade, so that’s seriously useful and allows me to work well even in difficult situations and that’s what making me work so smoothly in any situation.