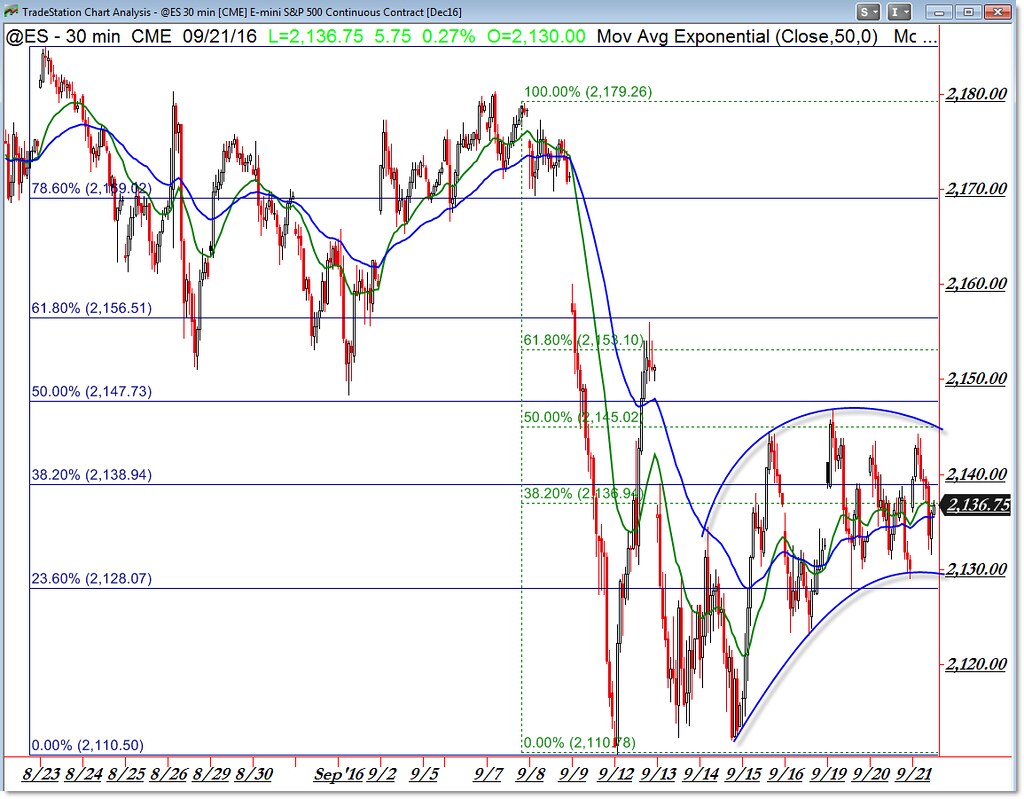

Fed Day Fibonacci Grid Update Sept 21

Will the Fed raise rates or keep them the same?

The answer to this question will determine whether we stay within our defined Fib Grid or break out of it.

Here’s today’s updated Fibonacci and Emini (@ES) trading levels for your plans and trades:

Here’s a reference guide of how to use and trade from these morning updates.

I drew a smaller grid which builds off the 2,180 swing high and captures the recent intraday reversals better than the larger grid.

We’re still working on the 2,139 level as our pivot within our 2,145 and 2,128 levels.

We’ll hear what the Fed does shortly – and the expectation is that they NOT raise rates.

Of course, BIGGER price swings occur when there is a surprise….

Want these levels and additional strategy planning in advance each evening?

Get these levels in advance with in-depth planning and trading opportunities by joining the Daily Membership.

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Thanks for the levels. Will be very curious to see how markets play out this afternoon!

It’s vital that we keep things simple especially regarding Fed since it obviously makes noticeable difference and if we are not doing things properly then we will only throw chance of success. I am doing it all right through OctaFX broker using their mind blowing facilities and features especially with small spreads, high leverages, zero balance protection, 15% stop out level while there are also daily market updates plus monitoring system to know what traders are working on and much more, it all works nicely in my favor.