Fed Day Market Update and Stock Scan Sept 17

After yesterday’s strength, we have today’s retracement of the bullish reversal.

Though price pushed to new highs, it was on negative divergences and we’ve seen downside action so far this morning.

The afternoon gives us a “Fed Day Announcement” which could radically change the structure, but first, let’s update our S&P 500 chart then highlight the top trending stocks of the day.

Positive Divergences suggested a bullish reversal which occurred this week. Now negative divergences at a new high similarly argue for caution.

We’ll use 2,000 as a simple reference level and will play cautiously/bearishly beneath it and otherwise bullish – throwing caution to the wind – above.

Again, the “Fed Day” announcement and press conference begin at 2:00pm EST so read the statement and monitor the often volatile price action that develops into the close.

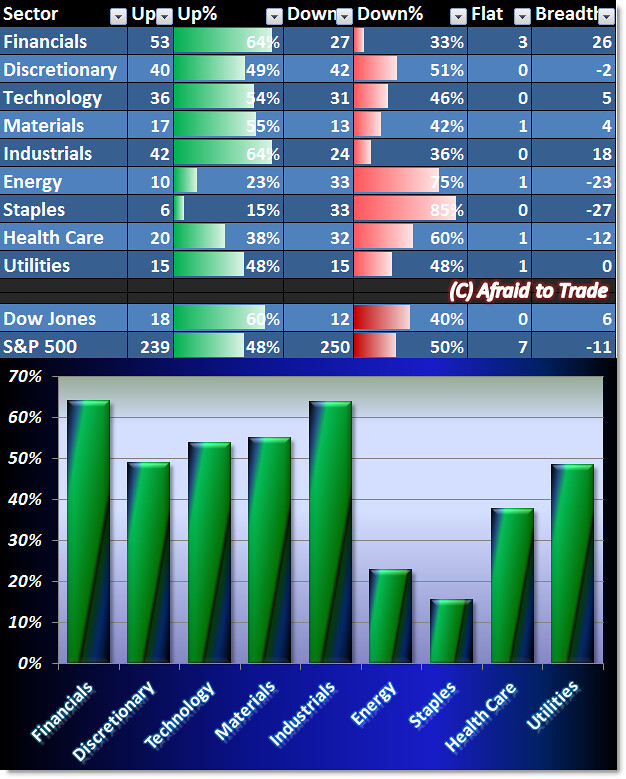

Not surprisingly, Sector Breadth is Mixed:

Our top two sectors are Financials and Industrials (with strength in the other offensive names) which is actually bullish and our weakest sectors are Energy and Staples (which is also net bullish).

Not to be outdone, Utilities join with the bullish sectors. This isn’t a pure bullish picture but it’s slightly more bullish than bearish at the moment ahead of the Fed announcement.

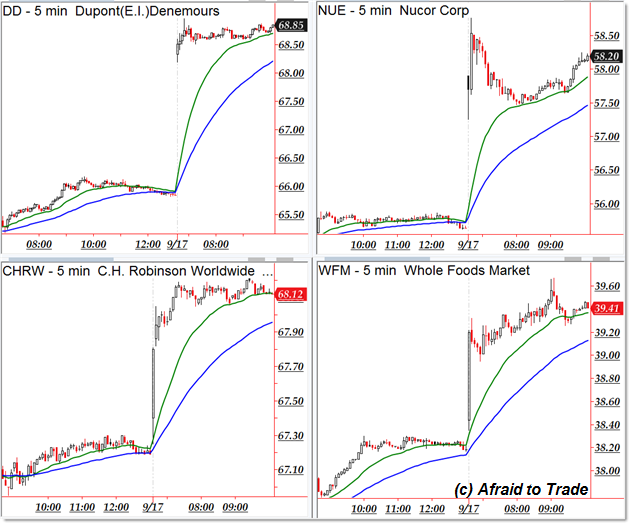

Potential bullish trend day continuation (buy retracements) stocks include the following:

Dupont Denemours (DD), Nucor (NUE), C.H. Robinson (CHRW), and Whole Foods (WFM).

Today’s downtrending stock scan includes the following bearish candidates today:

Owens-Illinois (OI), General Mills (GIS), FMC, Conagra Foods (CAG).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).