Five SP500 Stocks Showing Strong Intraday Trends

For intraday traders, it’s often difficult to buy a strong stock in a strong intraday trend. The minute you buy will be the minute the trend reverses, you think.

However, this can be an excellent strategy for new traders to practice, particularly when trying out trading pro-trend or retracement strategies.

Let’s take a look at five stocks in the S&P 500 that specifically showed a strong intraday Trend Day.

In alphabetic order (discussion after the 5-min intraday charts):

Allergan (AGN):

Dominion Resources (D):

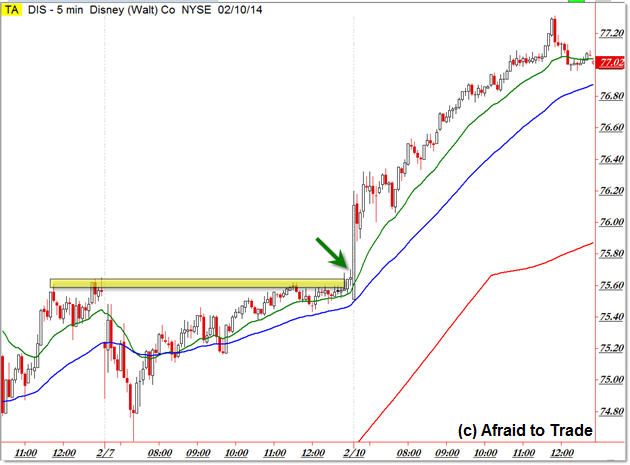

Disney (DIS):

Hershey Company (HSY):

Zimmer Holdings (ZMH):

For background information on recognizing and trading Trend Days, see my “Compilation of 21 Posts on Trend Days” for plenty of free educational material and strategies.

Also, use the logic of the daily chart post “Strong Stocks Getting Stronger.”

For a bonus, take a look at my recent reference post on a “Bullish Seasonality in Hershey’s HSY” which appears to be playing out successfully.

Most of our trades fall into the category of “Pro-Trend” (with trend) or “Counter-Trend” (against trend) strategies. For example, simple retracements such as “Bull or Bear Flags” fall into the Pro-Trend Category along with most Breakout Trades.

We’ll focus our attention on these simple pro-trend retracement strategies as seen played out in the five intraday stock charts above.

In an ongoing uptrend, look to buy shares (put on positions) either when price touches a rising intraday moving average or trendline (especially the green 20 period EMA seen on all charts above) or breaks above a falling ‘flag’ trendline you can draw by hand on your charts.

Look to trail the stop either between the rising 20 and 50 EMA (5-min) or – if you can handle the risk – trailed beneath the rising 50 EMA (if it is not too far away from your entry).

Exit pro-trend retracement trades when price breaks under a rising trendline (hand-drawn) or under a 5-min reversal candle low. Alternately, one can hold a “core” position until the end of the day assuming price never trades under the rising 20 EMA (and of course continues rising above it).

I wanted to highlight these names and use these as educational resources of the power – and opportunity – of strong intraday trends.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning parameters as we watch a “hold and bounce” or “break and retrace” scenario play out in the near future.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

2 Comments

Comments are closed.