Flailing within the Fibs Emini Update March 13

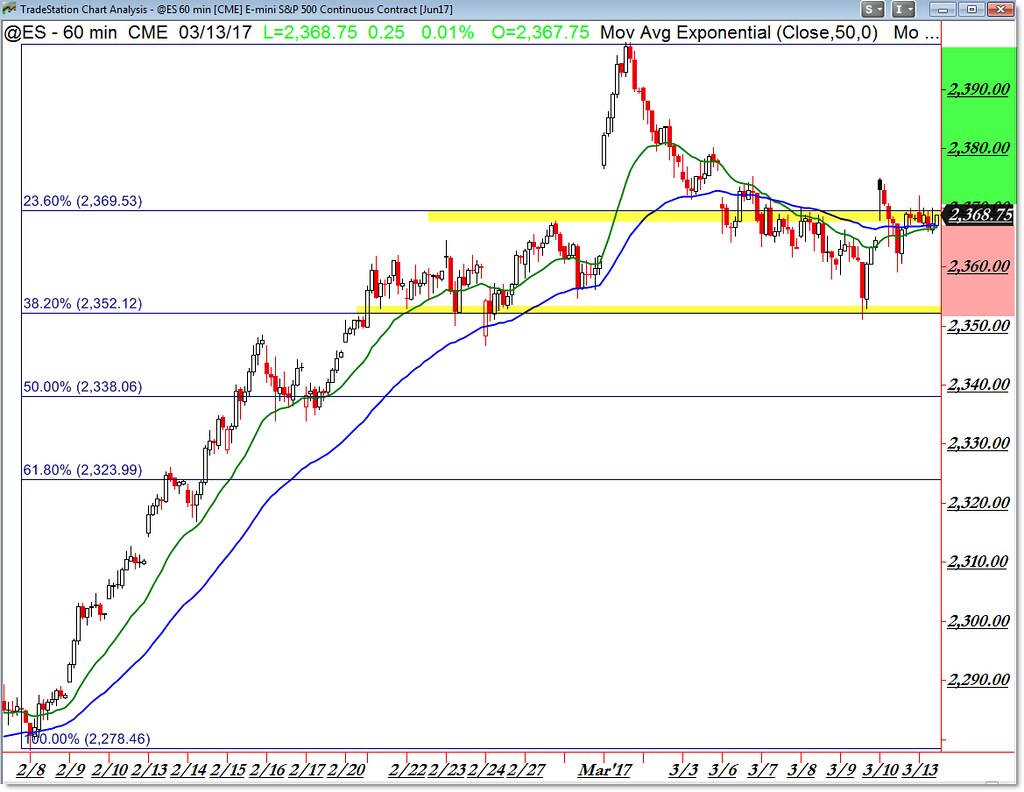

After gapping higher Friday, stocks stalled beneath our key short-term Fibonacci Level.

We’re seeing price trade just shy of this level so far today. What’s the level and what’s the plan?

Here’s today’s updated Emini (@ES) trading levels for your trades:

We’re once again focusing on the 2,368 @ES level (highlighted) as a key make-or-break bull/bear pivot.

Note the green “bullish pathway” above and the red “sell pathway” beneath the price.

This is a zoomed-in updated Fibonacci Grid so be sure to use it for your intraday trading reference.

If you’re new to this style of simple level trading, welcome aboard and keep checking back or get more details beyond just the @ES (stock scans, money flow, education) by becoming a member!

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).”