GOOG Shows the Importance of Watching Prior Price Lows

I wanted to follow-up and highlight an interesting point in the recent price rally in Google (GOOG) – specifically with regard to the price bounce off the key ‘last-support’ level I previously mentioned.

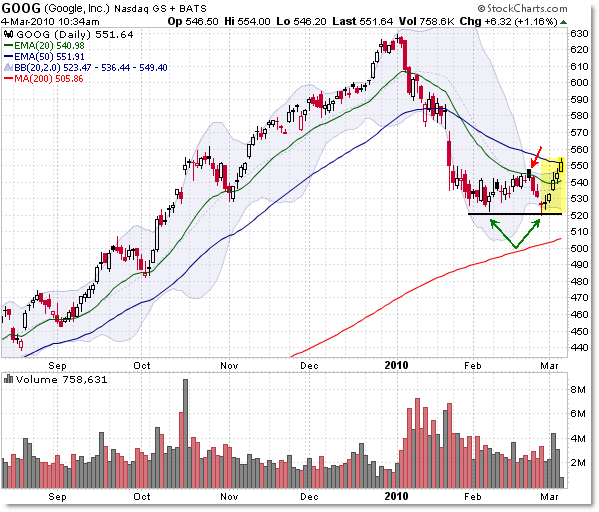

It’s an interesting lesson that’s worth repeating – here’s the chart:

I had mentioned previously that the $520 level was the confirmation point in the otherwise ominous signs, including a bear flag short-sell entry (red arrow at $545).

Aggressive (risk-seeking) traders would go ahead and short at the 20 EMA to play for a new low yet to come, while conservative (risk-avoidant) traders would need to see a confirmed break under $520, shattering prior price support, as their entry point short.

I think this shows a great example of how important it is to monitor open positions and also – for some traders – to wait for confirmation before putting on a position.

The $520 level formed a simple boundary between expecting a potential support bounce (it happened) or confirming that odds favored downside action and targets.

As was the case here, Google formed two doji candles at the $520 level – the critical line in the sand – and rallied the last four trading sessions as aggressive bears covered positions in a mini-short squeeze rally this week (on higher volume!).

This serves as a testament that highlights the importance of simple technical levels – such as prior price support zones – as being key to interpreting the potential of the next swing in price.

It’s back to the Mark Douglas style of thinking – “Find a price/line that price either has to break through or bounce off of, creating opportunity depending on what happens at that level.”

If you were short from the $545 level, the two doji candles and the price break above the second doji on February 26th was a sign to take profits and perhaps stand aside to see how far a bounce could go.

A break under $520 would have been a trigger both to exit any long/buy positions (playing specifically for a bounce) or to put on new short-sale positions.

That’s exactly why we seek to find “Lines in the Sand” on our charts – they’re important levels that distinguish between bull and bear; buy and sell.

Google here reminds us that you don’t have to use complex charting skills to find these areas – simple prior price support or resistance levels work just fine.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

GS, breakout or fakeout?

For now, it looks like a true breakout, or at least a breakout that's no doubt beginning with a short-squeeze 'popped stops' play.

I'll try to update that in a post – good call there.

Thanks Corey. I have 16.88 as a critical level for FAZ, if that's broken to the downside I think we could see more upside on GS. At this point I'm betting that GS will at least revert to the mean by pulling back a little.

I'm seeing the $16.40 level for BAC as critical. I'm looking to BAC as an indicator for financials, it could be flashing ominous signs for the rest of the sector. BAC has been trending down all week, while we could be witnessing blow off tops in GS, MS, and WFC. JPM has gotten choppy. I'm long FAZ with a short term target of 17.42 to 18.76.

Great lesson on “K.I.S.S – Keep it simple, stupid!”

maybe unrelated, but interesting intraday action in $GS pushing highs while @mrtopstep was calling out $GS floor traders quietly accumulating $SPX before the pop into the close. Do they know something about the NFP tomorrow morn?! (that's rhetorical…they always do 😉

Great lesson on “K.I.S.S – Keep it simple, stupid!”

maybe unrelated, but interesting intraday action in $GS pushing highs while @mrtopstep was calling out $GS floor traders quietly accumulating $SPX before the pop into the close. Do they know something about the NFP tomorrow morn?! (that's rhetorical…they always do 😉