Huge Market Reversal Bullish Surge Update Dec 4

Wow! As if the market didn’t need another reason to rally in the ongoing uptrend, today’s better than expected Jobs Report served as the catalyst for buyers to re-enter and short-sellers to cover.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

In-depth analysis is always provided to members of the Premium Daily Reports – I hope you’ll join and benefit.

We were looking for any type of rally or bounce off the 2,045 support target with positive divergences.

The Jobs Report (better than expected, including prior month positive revisions) was the catalyst that ignited this reversal and bullish surge – a back-to-back Trend Day that could take us all the way to 2,100.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

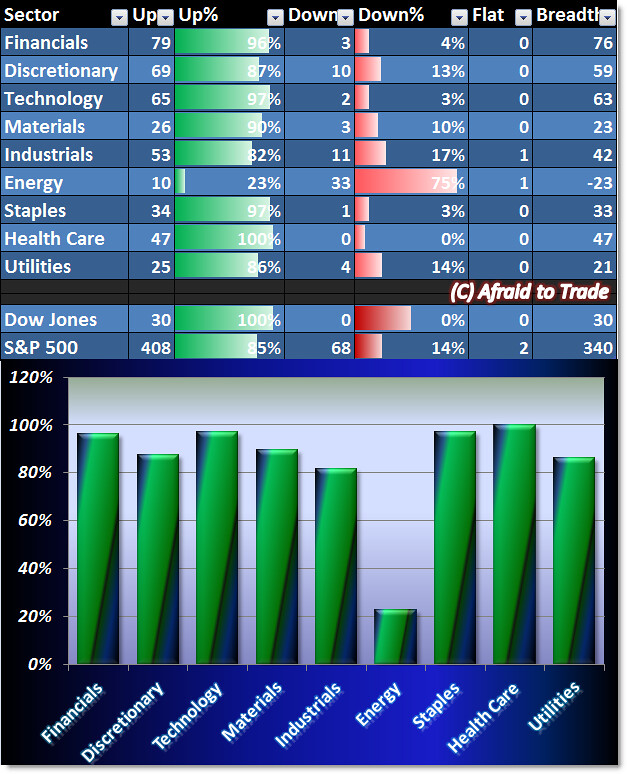

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Money is flowing into every single sector and almost every single stock today… except Energy.

Note the broad market grid below along with our graph above to see the strong bullish money flow.

We will always trade WITH dominant money flow and never against it.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

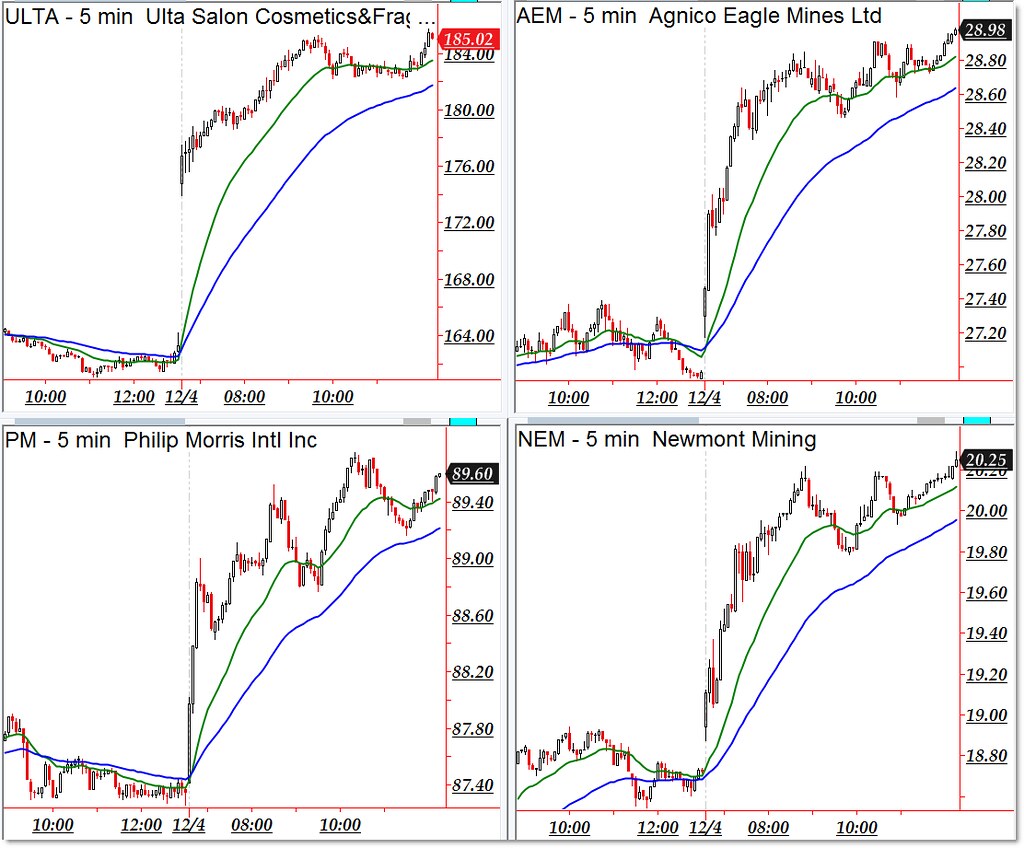

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

ULTA Salon, Agnico Eagle (AEM), Philip Morris (PM), and Newmont Mining (NEM)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Targa Resources (TRGP), Oneok (OKE), Rackspace (RAX), and retailer Big Lots (BIG)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

It is always really pleasing to be able to make entry in these situations, but of course we need to make sure we have right money management in place, as that’s the only way we will get results in our favor. I don’t have to worry all that much since I am using strict money management due to OctaFX broker’s 50% bonus on deposit, it is not just great because of size, but also due to the policy which makes it use able and that really makes me feel great.