Indicators the Disciplined Investor is Watching Feb 22 Volume

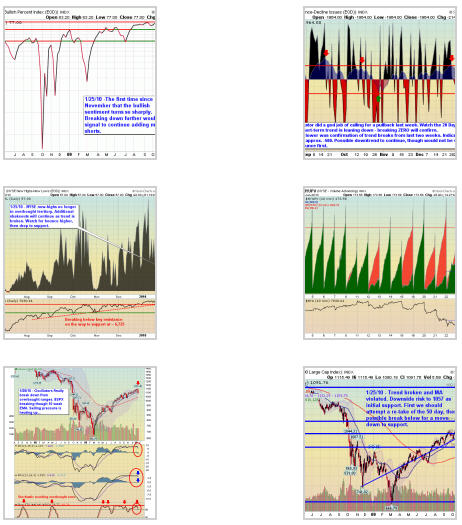

This week’s edition of the Disciplined Investor’s “Indicators We are Watching” focuses squarely on an issue I’ve been monitoring closely as well – that of the “strangeness” of the current market rally on declinging volume and market internals.

This week’s post is entitled “The Low Volume Rally is Suspect,” and Andrew Horowitz shows a quick snapshot of not just the current rally, but also a quick chart on gold, oil, coal, and more.

This week, Andrew writes:

“The low volume rally for major indicies does not provide a clear direction as there is limited conviction by the bulls. Even so, several indicators turned higher as the recent correction allowed a lift from an oversold condition.

Oil is hitting hard resistance and the U.S. dollar finally broke above key resistance. This week will probably show us if the downtrend for equities is broken or if last week was simply a relief short-term relief rally.”

These are always great ‘snapshot’ charts to start your week and I’m thankful for Andrew and staff for sharing.

Corey Rosenbloom, CMT