Intraday Reversal Market Update and Stock Scan April 13

Buyers pushed the market above the breakout but failed as they encountered thin air at the highs.

A big divergence preceded this reversal.

Let’s dive inside action and note key levels and the trending stocks of the day:

Buyers shot the market higher Friday, and attempted to bully the market to new highs this morning but so far they failed.

The breakthrough above 2,100 was a BULL TRAP, preceded by a lengthy negative Market Internal Divergence, and we now watch and trade the reaction as price breaks back under the 2,100 level.

We’ll use 2,100 as our critical intraday pivot where bullish plays will be favored above it and continuation bearish opportunities beneath it.

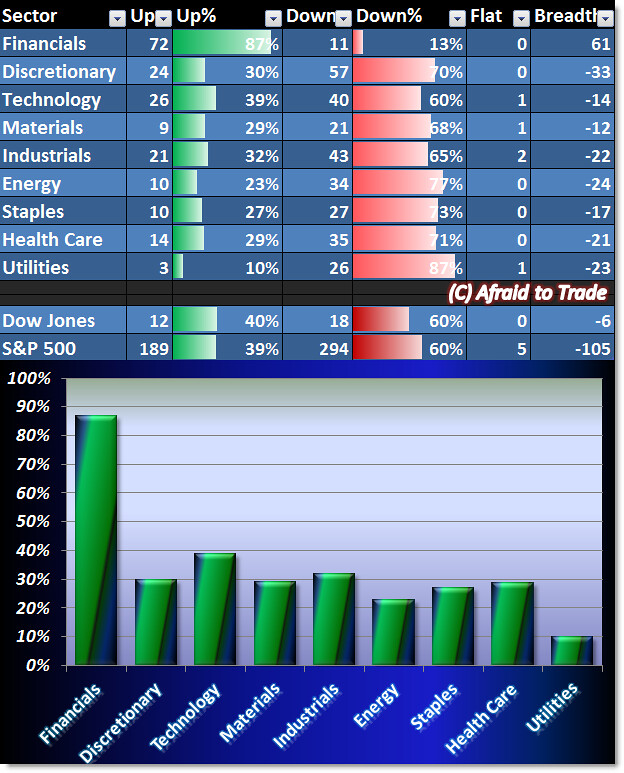

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

At the moment, Energy, Materials, and Health Care are strongest with defensive Utilities weakest today.

That doesn’t give us much information as to broader money flow, especially when almost all sectors are near the 50% Breadth mark (which is the same as the sideways action in the S&P 500 as seen above).

You can’t create opportunities that aren’t there – markets and traders remain in a holding pattern now.

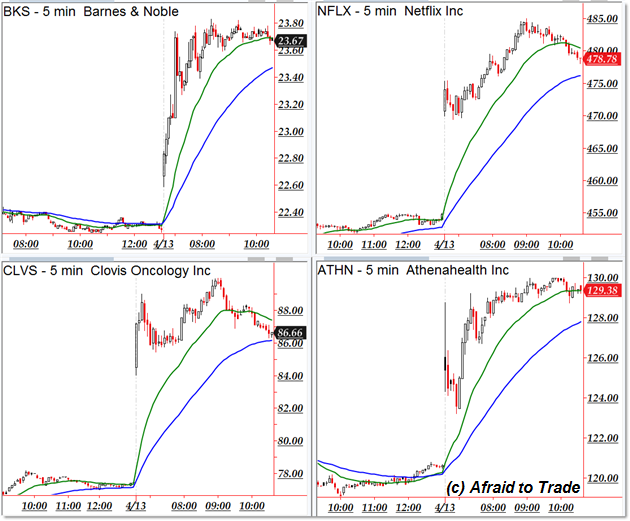

We have potential bullish trend continuation plays in the following stocks from our scan:

Barnes & Noble (BKS), Netflix (NFLX), Clovis (CLVS), Athena Health (ATHN)

Potential downtrending candidates exist in stocks showing relative weakness today:

BHP Billoton, Cinemark (CNK), 58.com (WUBA), and Tesoro (TSO)

I’m excited to announce that I’ll be joining six other great speakers at a Two-Day intensive boot camp in May!

Check out the details and start planning the trip today to join us in May.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Reversal can be seriously good way to make money, but at the same time risk factor is present too, so in such case we got to be very careful and take all decisions wisely. At the moment, I am keeping my safe side and that’s to do with help of OctaFX broker through their rebate program where I am able to earn 15 dollars profits per lot size trade including the losing trade too, so that’s why this is just so good for all.