Jan 26 Recovery Market Update and Trending Stock Scan

Stocks stalled after surging from the QE intervention announcement in Europe.

However, today’s session saw a sharp recovery and we’ll begin our update with the bigger picture chart.

Here’s the intraday S&P 500 and levels to watch for planning:

Thursday’s session saw a straight-up rally as expected from the announcement that the ECB would intervene with a 1 trillion stimulus.

We still seem to be in an environment where traders behave with a knee-jerk reaction to “stimulus equals buy!”

However, Friday and today’s morning session saw a pullback from the reaction high.

We’re building off the 2,040 level as shown. A further pullback targets the three lower Fibonacci levels.

Otherwise it’s on to new highs above 2,060 as part of this new environment of euphoria for money-printing.

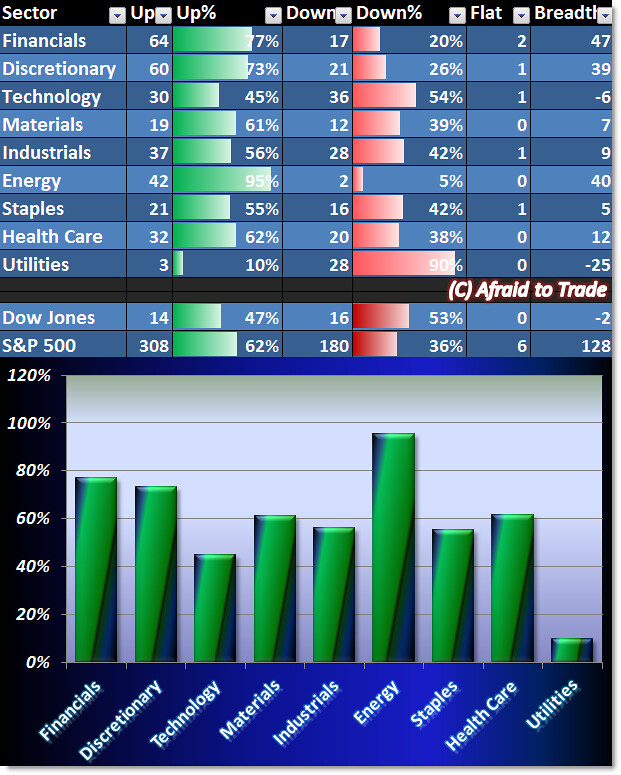

Breadth strongly confirms the rally:

All sectors are muted today with most sectors reporting a 60% Breadth level.

Utilities is the weakest sector while – surprisingly – Energy is the strongest even as oil plunges to new lows.

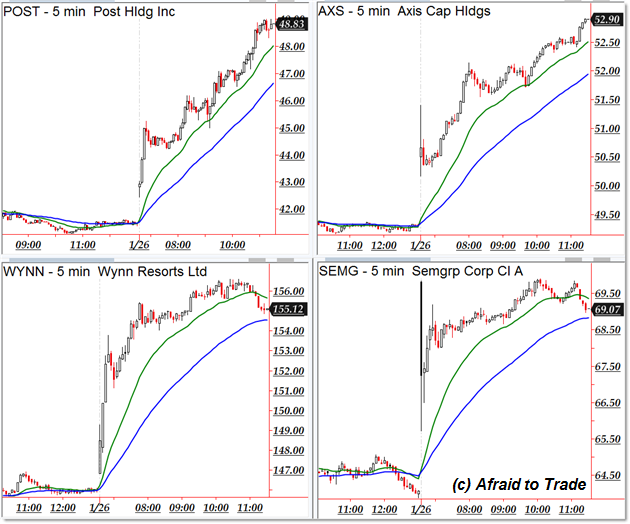

We have potential bullish trend continuation plays in the following stocks:

Post Holdings, Axis (AXS), Wynn Resorts, and Semgroup (SEMG)

Potential downtrending candidates exist in stocks showing relative weakness today:

Hewlett-Packard (HPQ), United Tech (UTX), Dow Chemical (DOW), Intel (INTC)

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).