July 17 Flat Market Update and Big Mover Stock Scan

Despite the strength of technology leaders Google and Facebook (among others), the S&P 500 is perfectly balanced and flat today despite the NASDAQ’s bullishness and new all-time high.

Let’s scratch the surface and look beyond the headlines to what’s trending today:

Traders in the NASDAQ and Tech Sector Stocks are probably having a lot more fun today than index futures traders!

Nevertheless, we always start with a top-level picture of what the index – especially the S&P 500 – is doing and then drill-down to specific sectors and stocks within sectors from there.

Right now, there’s nothing exciting going on in the S&P 500. Price is consolidating after a stellar rally.

Negative divergences (into resistance) undercut the rally and make us more cautious.

However, the strength in Tech Sector names (we’ll see shortly) keep us from being bored during today’s range session.

Follow along with members for more precise daily planning, analysis, and education.

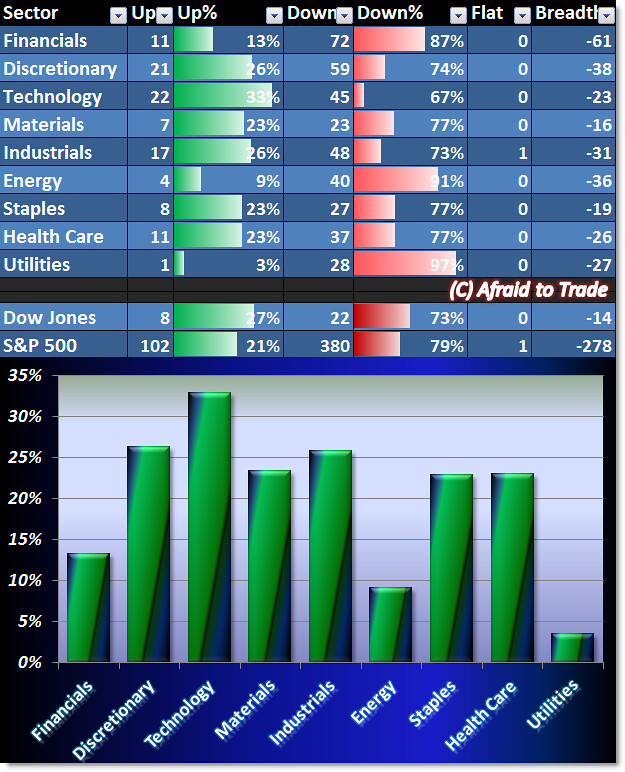

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Speaking of Technology, even with big headline gappers and strength in Google (GOOGL) and Facebook (FB), the Tech Sector “only” shows a positive breadth reading of 33% (of stocks positive right now).

This is a big divergence and non-confirmation, or signal that not all is bullishly enthusiastic with the broader market.

Financials, Energy, and Utilities (which were yesterday’s leaders) are the weakest sectors today.

Ok without further ado, let’s highlight our algorithmic stock scan’s top candidates (all Tech names).

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Baidu.com (BIDU), Google (GOOGL), Yahoo! (YHOO), and Facebook (FB)

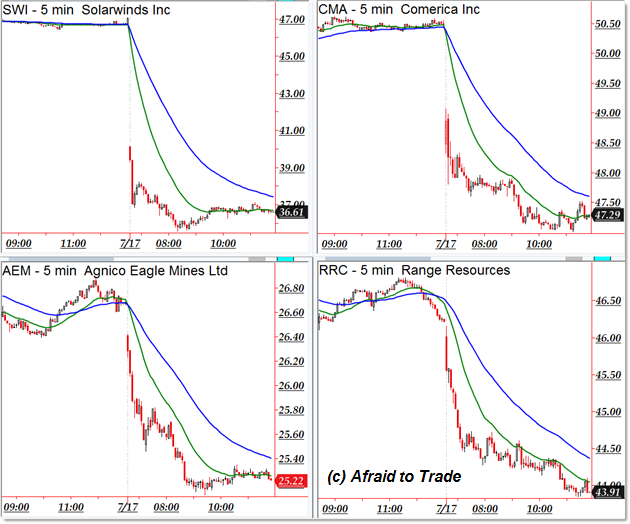

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Solarwinds (SWI), Comerica (CMA), Agnico Eagle (AEM), and Range Resources (RRC)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

It’s tough to trade now when the market has went so far with this, I believe now we should wait for really perfect point, if we work without getting there then we could lose. I won’t take any chances even though I have world class company OctaFX to rescue me with their Rebate service, it allows me to gain 15 dollars whenever 1 lot size is traded, so this works well for me to be aggressive due to knowing of the backup there is!