July 23 Selling Market Update and Big Stock Scan

After a small morning bounce off support, stocks continued falling along the sell pathway from the daily chart.

Let’s scratch the surface and look beyond the headlines to what’s trending today:

The 2,110 level was a Fibonacci Target spot and price rallied just shy of the 2,120 level.

Further selling intensified as price broke this 2,110 support level, resulting in the big sell swing were seeing now.

The target extended to the 2,100 level and price is just beneath the key “round number” at this point.

We’ll focus our attention for the moment on the 2,100 higher frame target as a bull/bear pivot.

Follow along with members for more precise daily planning, analysis, and education.

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

The strongest sector today is Energy, followed by Technology; these sectors are still at the 50% level.

Our weakest sectors include Financials, Materials, Staples, and Utilities.

Generally, this confirms the weakness or selling pressure we’re seeing continue on the indexes.

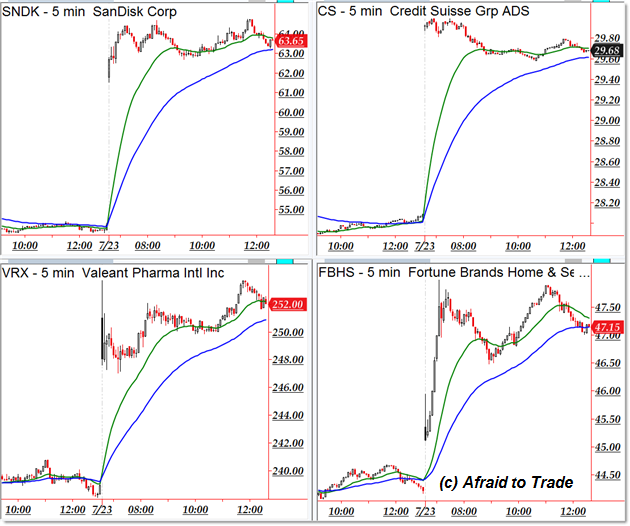

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

SanDisk (SNDK), Credit Suisse (CS), Valeant Pharma (VRX), and Fortune Brands (FBHS)

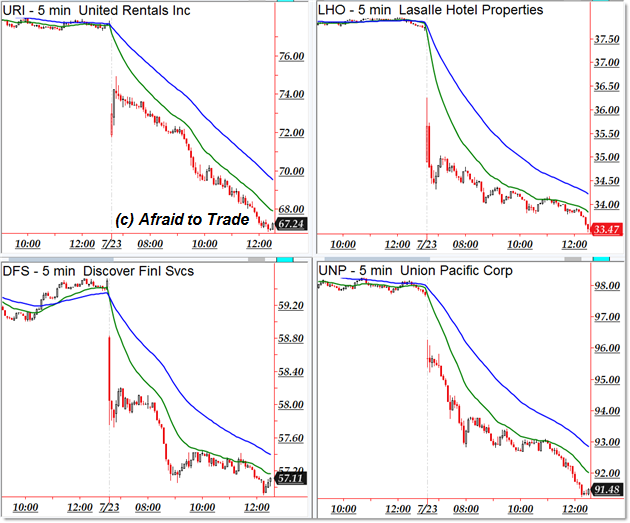

Bearish downtrending candidates include the following stocks from our “weakness” scan:

United Rentals (URI), Lasalle Hotel (LHO), Discover Financial (DFS), and Union Pacific (UNP)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).