July 30 Bounce Market Update and Trending Stock Scan

Buyers bought a downside swing this morning, resulting in a price swing back to the 2,110 resistance level.

What levels are we focusing on now? Let’s see!

For now, we continue to focus on two simple levels:

2,100 (Round Number) and 2,110 (Prior High).

Note the negative divergences building at the 2,110 level.

For short-term planning purposes, we’re neutral/cautious between 2,100 and 2,100; breakout bullish above 2,110 (to continue a short-squeeze towoard new highs); and bearish with caution (bulls remain strong) under 2,100.

We really won’t get super bearish intraday unless price is under 2,095’s swing low.

Follow along with members for more precise daily planning, analysis, and education.

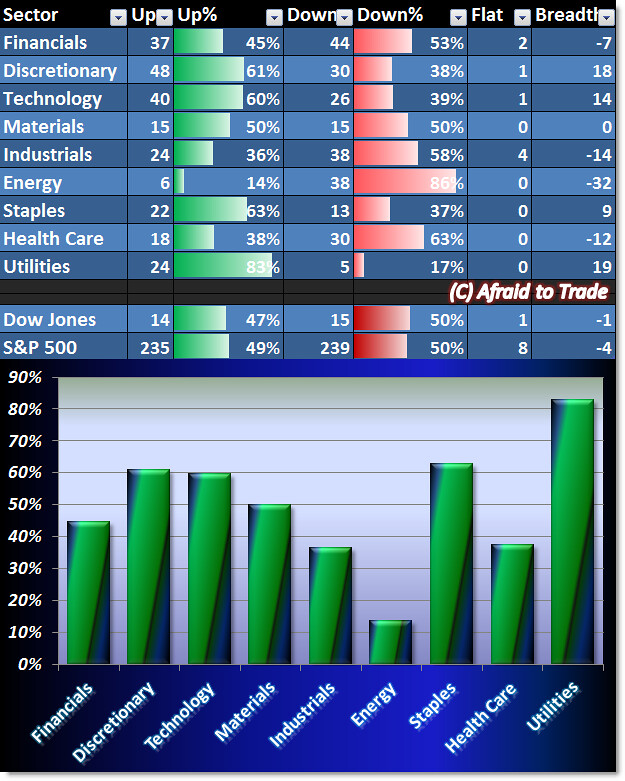

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

With the relative weakness – and divergences – in price today, we’re getting a mixed picture in breadth.

The picture tilts bearish with Utilities as the strongest sector, followed by Staples.

Nevertheless, strength is tepid but present in Discretionary, Tech, and Materials.

Our weakest sector for the day is again Energy.

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Hologic (HOLX), ACI Worldwide, Virgin America (VA), and GNC Holdings

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Qorvo (QRVO), Anheuser-Busch (BUD), Whole Foods (WFM), and Procter and Gamble

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

nice

I don’t think anyone can say whether the trend is up or down, as it’s uncertain and I believe when it’s not sure then we should not really do anything silly. I am not too great at analyzing yet I can perform well with having OctaFX broker at my side especially with their cTrader platform, it’s upgraded version and has made trading so much easier and I can use indicators easily which helps me decide about the trend easily and that makes trading easily.