July 7 Bear Trap Reversal Market Update and Stock Scan

Buyers won’t let the market roll-over, as proven with today’s power-buy rally off a support level.

What’s going on now and what levels are important? Let’s see:

In this morning’s TradeStation Morning Market briefing, I highlighted the likely price movement down toward the 2,040 level which is the rising 50 week EMA (and lower Bollinger Band).

Buyers responded with an intervention event, thrusting the market like a rocket ship up away from this level in yet another powerful V-Spike Intraday Reversals.

Nonetheless, price reversed with confirmation in TICK (internals) and Momentum, and now higher prices are favored after the false break or Bear Trap outcome this morning.

Follow along with members for more precise planning, analysis, and education.

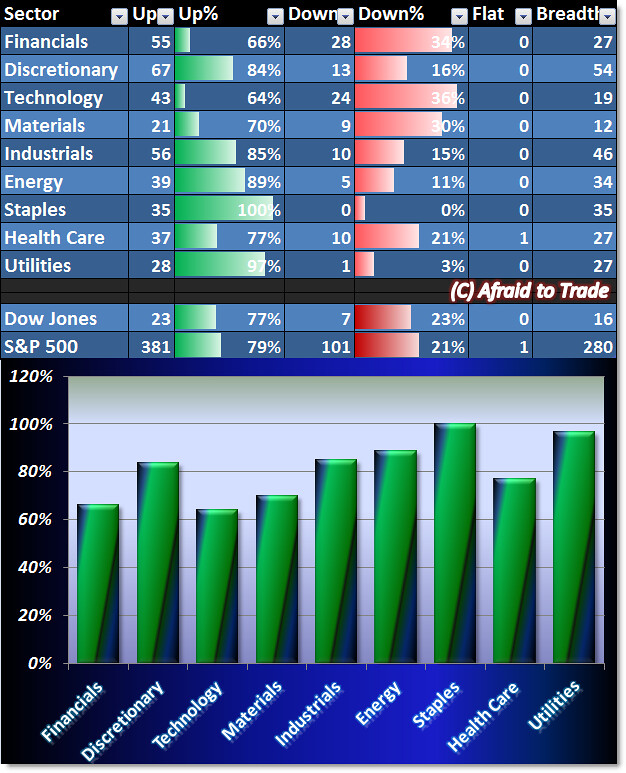

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

The chart above was taken prior to the close and it reflects across-the-board bullishness today.

All sectors are above their 60% Breadth level while Staples and Utilities near 100% (all stocks positive).

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

DepotMed (DEPO), PPL Corp, American Electric (AEP), and Kohl’s (KSS)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

HomeAway (AWAY), Tesla Motors (TSLA), Comerica (CMA), and Tata Motors (TTM)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

This reversal can be pretty special if we spot it correctly since that can lead into positive results and that too in a big way, so that’s why we must look to do trading this way. I am lucky that I work with OctaFX broker where I can spot any opportunity very easily thanks to their terrific cTrader platform which has highly upgraded system where there is also advance charts, so that’s really makes it really good for us to use it!

I love trading with keeping support and resistance levels upfront, as I use indicator that provides these lines, so that’s why I am able to trade without much trouble or issues. It is still important that we keep large money management, I get great hand with OctaFX broker given the massive 50% bonus on deposit offer, it is awesome and makes me trade with full aggression without facing any huddle, so that obviously helps with the performance big time even in most difficult situation.