June 10 Retracement to Target Market Update and Stock Scan

Retracement! Price fell down away from the 2,120 target as expected toward the 2,100 level – a key pivot.

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

First, let’s view this morning’s update on the S&P 500 with respect to the broader picture and key levels.

You’ll find our “pullback planning” logic which was correct now into the 2,100 pivot level.

After an initial bounce off 2,110, price gapped lower and collapsed (gap open) into 2,100.

We’re focusing now on the Red/Green Price Pathways away from 2,100 as highlighted above.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

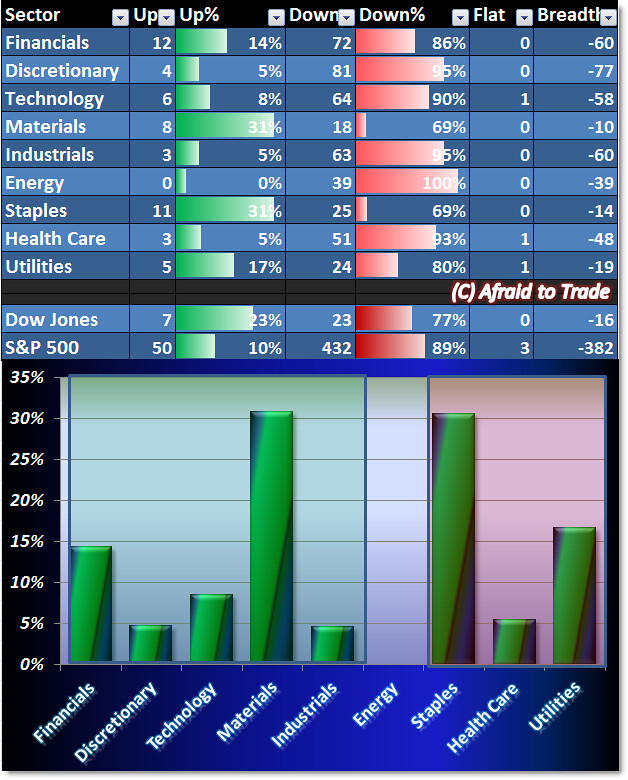

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

No sector is strongly above the 30% Breadth Level and Energy has zero stocks positive at the moment.

This type of money flow aligns with the bearish price action and risk-off phase we’re currently seeing.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

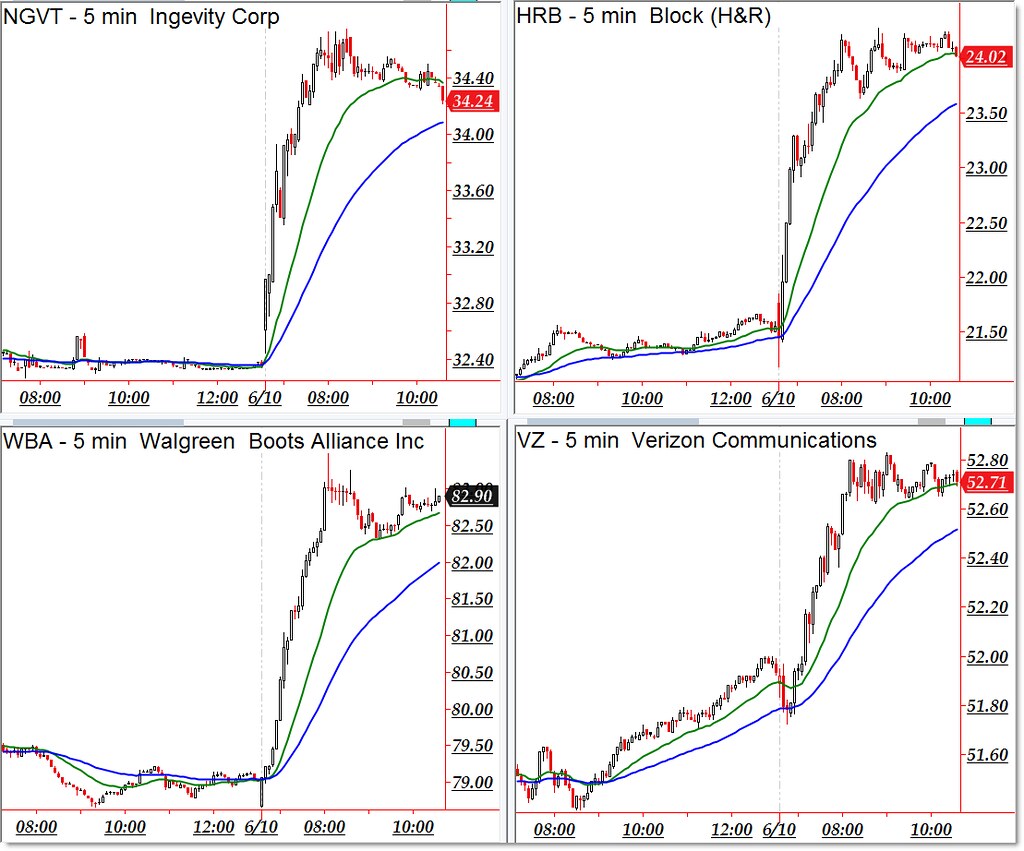

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Ingevity (NGVT), H&R Block (HRB), Walgreen Boots (WBA), Verizon (VZ)

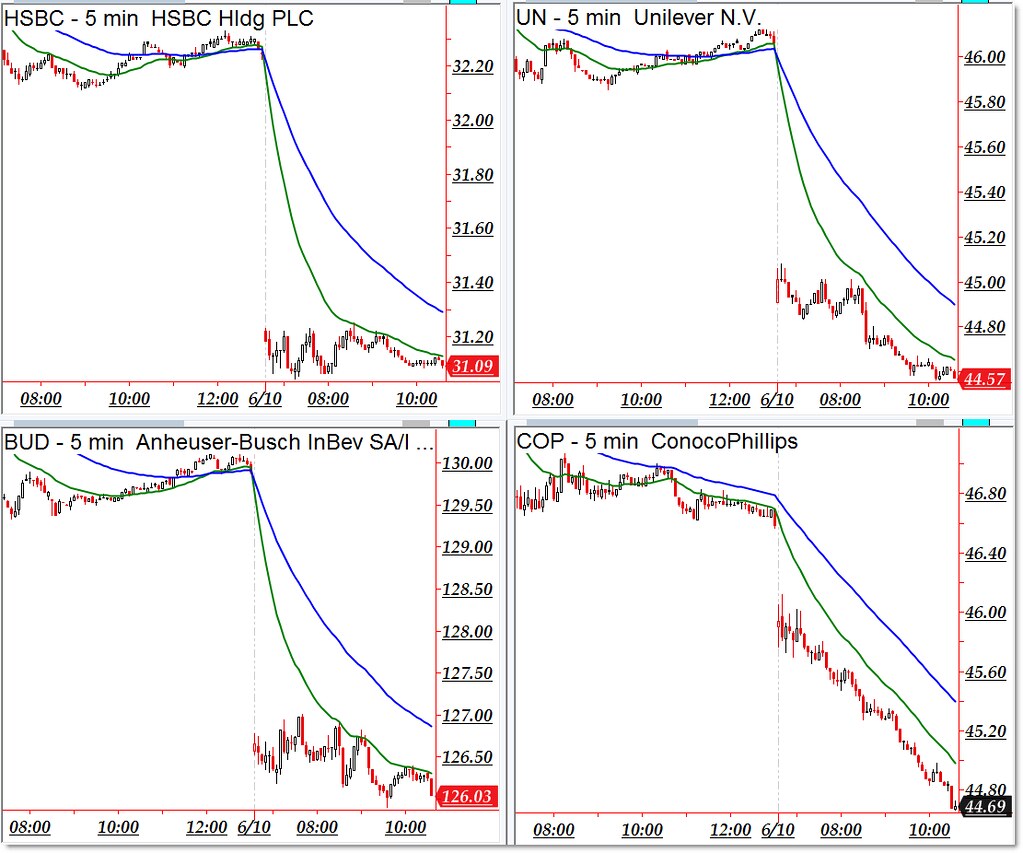

Bearish downtrending candidates include the following stocks from our “weakness” scan:

HSBC Holdings, Unilever (UN), Anheuser-Busch InBev (BUD), and Conoco Phillips (COP)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

This could be good chance to enter into trade but we need to keep good money management in place in order to work things out. I am currently trading with OctaFX broker and that’s where I get great help and it’s through their magnificent 50% bonus on deposit which is use able while they also have just 5 dollars limit as far deposit goes, so all this is seriously handy and helps a lot with trading with comfort and ease.