June 12 Sell Swing Market Update and Stock Scan

Divergences yesterday gave way to a short-term reversal and sell-swing breakdown today.

What levels are important now after the breakdown under 2,100? Let’s see!

Be sure to reference Wednesday morning’s “Trading the Expected Rally (Reversal) off Support.”

Follow-that up with this morning’s “More Divergences and Level Planning” update.

With those firmly in mind, price broke under the 2,110 level to begin today’s Trend Day down.

Pay close attention to the message of market internal and momentum divergences.

For now, price stabilized at the 2,095 level and we’re seeing a breakdown toward 2,090 which is our reference.

Should price push to new session lows, it would likely continue lower under 2,090 in a Trend Day movement.

Otherwise, look to be cautious at current levels with respect to a slight pick-up in volatility.

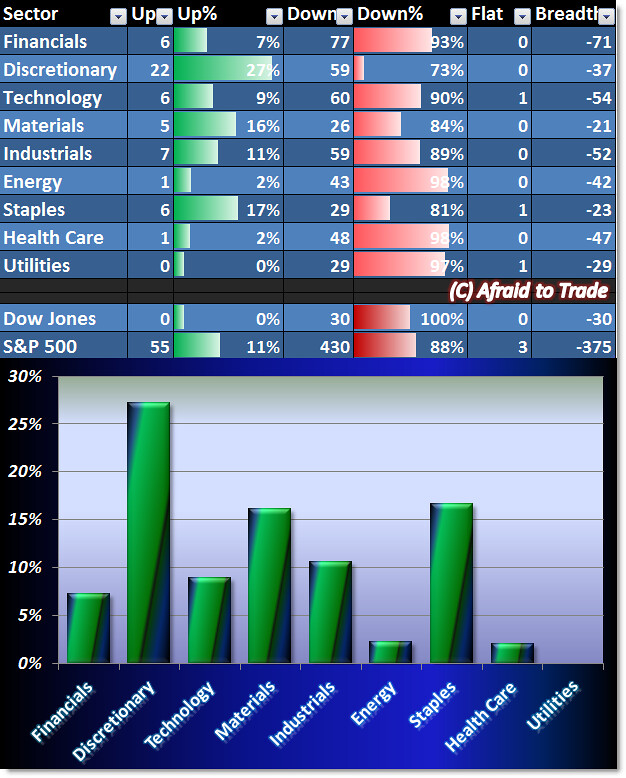

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

While Breadth yesterday was strong – with a hint of bearishness – today’s breadth is weak with an ever so small hint of bullishness.

The strongest sector is Consumer Discretionary with 25% of stocks positive right now.

Otherwise we have across-the-board bearish/liquidation money flow.

The hint of bullishness – besides Discretionary – is that the weakest sectors are the defensive names.

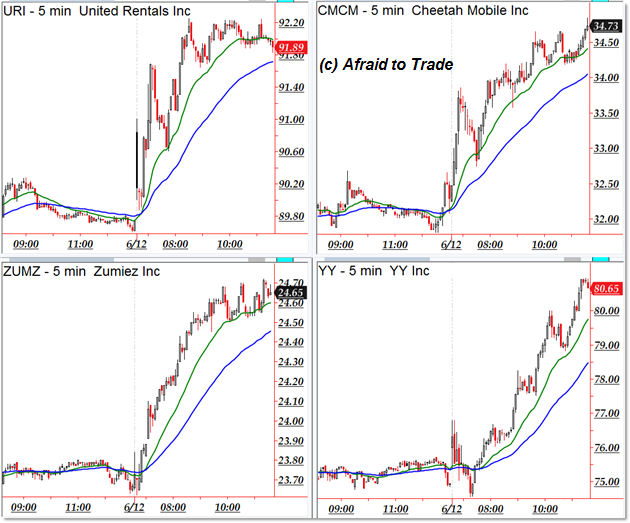

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

United Rentals (URI), Cheetah Mobile (CMCM), Zumiez (ZUMZ), and YY.

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Albemarle (ALB), Linear Tech (LLTC), Merck (MRK), and Aetna (AET)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

In my view having daily market updates is brilliant and that really to trade and this site is just master piece in providing daily updates, I am regularly following this and that is the reason I am getting so much success in Forex trading. I am extremely pleased to follow these type of service where there are no charges at all and I am getting similar stuff with my broker OctaFX, it also provides daily market updates for free that too daily.

We need to be pretty careful when it comes to reversal type trades, it might be mouth-watering initially but if we get it wrong then it can be a disaster especially during a strong trend. I always prefer to follow the trend instead of seeking reversal unless it is absolutely on. I get massive help with OctaFX broker where they have great analysis service, it is free to use yet highly effective while this blog too is pretty useful in that regard.