June 16 Bullish Dominance Market Update and Stock Scan

Buyers win again! That’s the case almost every day now so perhaps this shouldn’t be a surprise.

Price moved – as logic suggested – up away from the 2,070 level toward 2,100 where we are currently.

What levels are important now into 2,100? Let’s see!

Logically speaking, 2,100 is our simple “Key Pivot” reference level and we’ll use it in our short-term planning.

We’re outright bullish for more pro-trend (bullish) continuation above this level.

However, we’ll be cautious right now because the 2,100 target is in sight for today’s session.

A Trend Day (see our new “Trend Trader’s Perfect Pullback” Lesson Bundle) developed, taking price up away from the 2,070 level to where we are currently.

Let’s dig into Breadth to see additional clues about the health of the current rally.

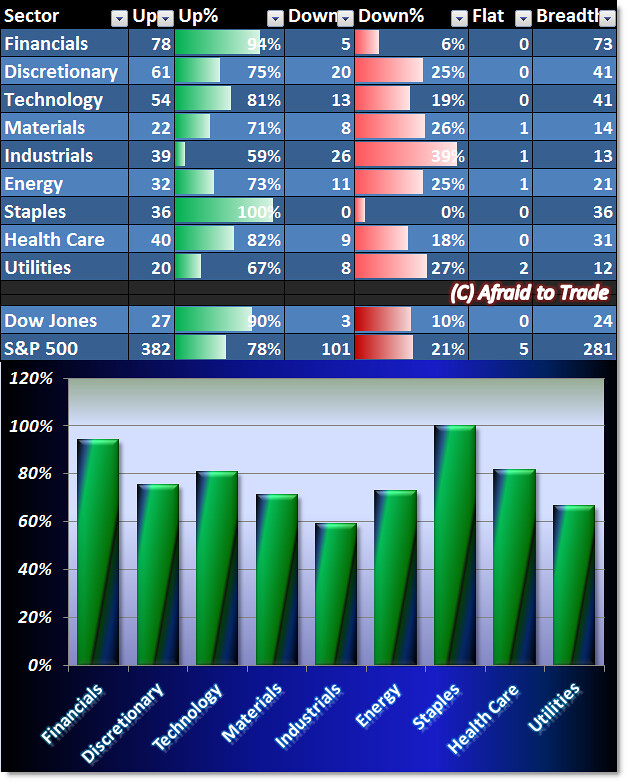

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

We’re actually seeing across the board Bullishness with a slight tilt to the defense.

The strongest sector today is the defensive “Staples” with Financials trailing Staples.

Despite these two, strength (breadth) is consistent which supports the bullish price action today.

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

COTY, Estee Lauder (EL), Axis (AXS), and Weyerhaeuser (WY)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Bloomin’ Brands (BLMN), Oshkosh (OSK), Terex Corp (TEX), and Southwest Airlines (LUV)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Bullish trend can be seriously profitable, so that’s why we need to be really good at picking it. I don’t need to really do much effort to find out what’s happening in the market, it’s all done in a simple way with OctaFX broker and their picture perfect analysis service, it’s just too good and allows us to succeed easily. I can catch any trend by it and that too completely free, so it’s just double bonanza for me having this lovely broker at my service!