June 2 Similar Trend Day Trading Update and Stock Scan

What levels are key in today’s session and which stocks are trend day trading candidates?

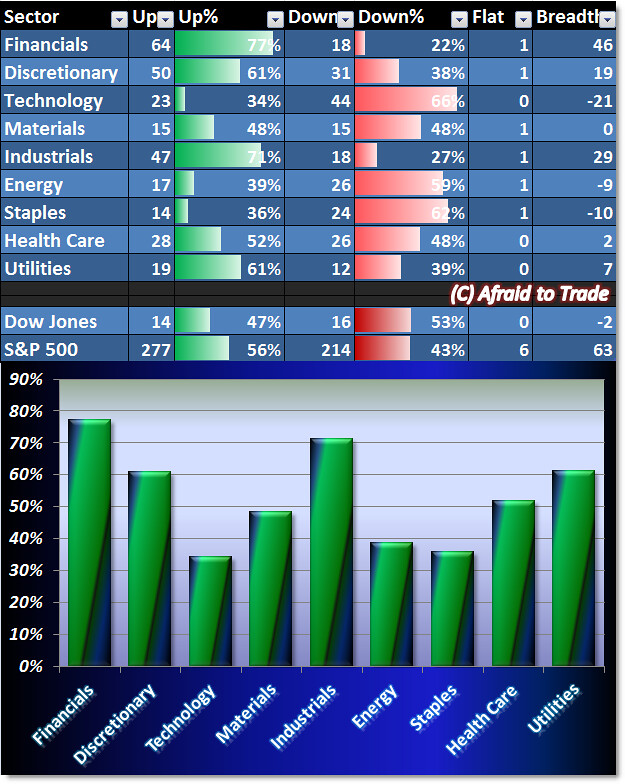

Here’s the S&P 500 key levels and Sector Breadth Chart at mid-day:

Before we discuss key levels, take a look at the five aggressive buy-impulses that stopped a market sell-off.

As long as buyers collectively are willing to keep putting money to work, price will continue trading higher against all logic or indicators to the contrary.

Our focal point should be the 1,925 upper resistance ceiling which will define bearish/cautious strategies beneath it and aggressive breakout “short-squeeze” bullish strategies above.

Otherwise the 1,922/1,923 price and EMA support level will define range support and bearish breakdown potential strategies beneath it.

Sector Breadth paints a mixed to bullish picture at the moment:

We see sector strength in bullish Financials and Industrials along with Consumer Discretionary (these are “Risk-On/Bullish” Sectors).

We also see slight strength showing up again in Utilities and – to a lesser extent – Health Care, both of which are traditionally Risk-Off/Cautious Sectors.

Look to trade strong stocks in strong sectors as a general strategy.

Today’s pro-trend trading candidates from our scan include the following:

Broadcom (BRCM), Home Depot (HD), PraxAir (PX), and L Brands (LB).

On the other hand, bearish trend day trading stocks (should we see a price reversal lower) include:

Biogen (BIIB), Cognizant Tech (CTSH), Nucor (NUE), and QEP Resources (QEP).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).