June 23 Intraday Trading Update and Stock Scan

After yesterday’s Fed Day surprise breakout, the market is taking a break and consolidating after yet another stellar upside rally.

Let’s highlight the structure and pay close attention to the key levels at the moment:

Our clear level to watch is the current 1,960 support zone of the prior high and earlier session low (yellow highlight).

We do note divergences in momentum and price yet this does not mean that price is required to reverse lower (although logic suggests that outcome).

For trade planning, we’ll thus be breakdown bearish on a failure to hold 1,959 but otherwise will be “Range Neutral” between the 1,960 and 1,965 two-day range.

We’ll continue “ignoring all evidence to the contrary” and trading a potential short-squeeze fueled breakout above 1,965.

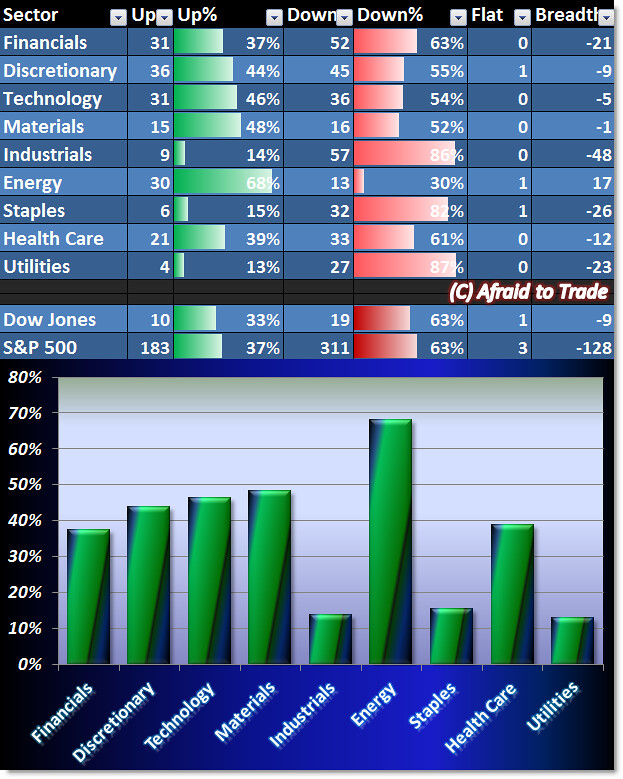

Our Sector Breadth Grid is mixed-bullish at the moment:

The strongest sector today is Energy (almost 70% of stocks are positive) while the three weakest sectors include the Industrials, Staples, and Utilities.

This is generally a bullish sign (strength in “offensive” names and weakness in “defensive” names) but the mixed picture further sends a caution signal as price continues within its two-day trading range.

Despite the sideways action, there are always bullish candidates to trade from our scans:

Freeport-McMoRan Copper (FCX), Vertex (VRTX), Dun & Bradstreet (DNB), and Petsmart Inc (PETM).

Bearish candidates include the following:

FMC Corp (FMC), Wisconsin Energy (WEC), McCormick & Co (MKC), and The Hershey Company (HSY).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).