June 25 Range Breakout Market Update and Stock Scan

After yesterday’s Trend Day Down, price stabilized at support into a morning Range Day.

However, mid-day we’re seeing an instant breakdown under support which calls our attention.

What’s going on now and what levels are important? Let’s see:

Here’s a key strategy planning quote from last night’s members-only update:

“…[P]rice would be slightly more likely to fall (to continue the range) than it would be to rise.”

“FOCUS ON PRICE and the equally-likely movement AWAY FROM the current midpoint/magnet levels here (2,100/2,110).”

A morning range gave way to a continuation of the expected/logical sell-swing in price as we see the market move “Down Away From” resistance with divergences potentially “Toward” lower support zones as seen above.

A true continuation of the range sets up a sell-swing back toward 2,080 but for today and the rest of the week, we’ll focus on the Fibonacci Retracement grid.

The break under 2,110 sets in motion a play toward 2,100 and then perhaps 2,095.

Each of these would be both targets and potential “support-bounce” zones for intraday traders.

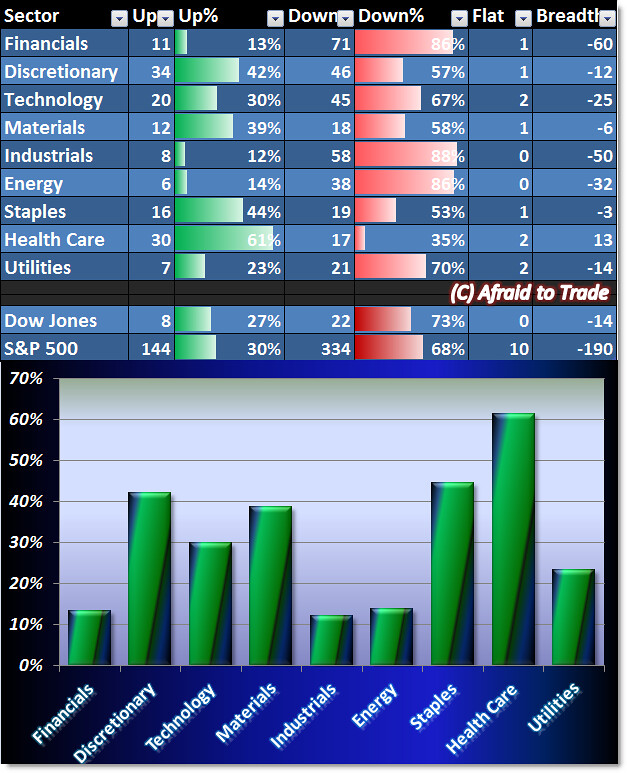

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Sector Breadth today confirms the expected sell (retracement) swing in the market.

All sectors are weak today again with Health Care – fresh off news from the Supreme Court upholding the Affordable Health Care Act (“Obamacare”) – leading the sector strength today.

Financials, Industrials, and Energy are near 10% Breadth while all other sectors trade under the 50% Line.

Like yesterday, bearish “risk off” money flow is occurring so far today.

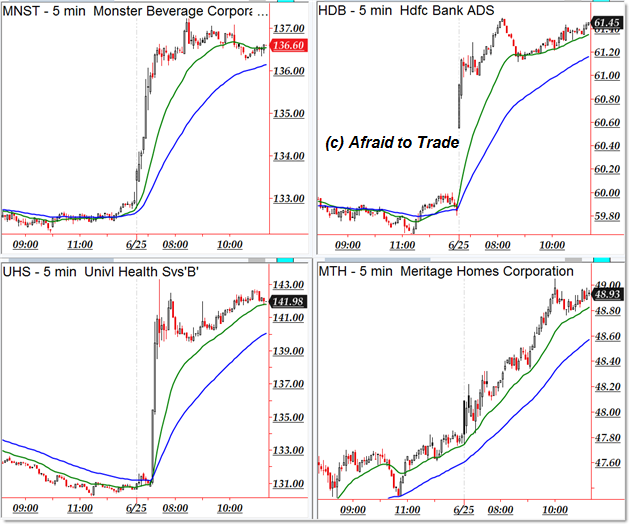

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Monster Beverage (MNST), HDFC Bank (HDB), Univ. Health Services (UHS), Meritage Homes (MTH)

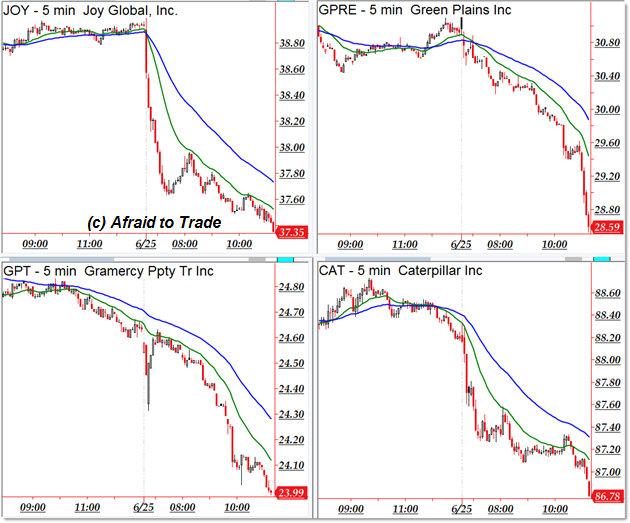

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Joy Global (JOY), Green Plains (GPRE), Gramercy Property Trust (GPT), and Caterpillar (CAT)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Range break out can be seriously profitable, so that’s why if we use it correctly with the trend, it can bring great rewards and that’s where I am very lucky that with a great broker like OctaFX, I can get great help with their excellent news and analysis facility, so trading with this means I am always successful and even if I fail it’s not huge losses due to strict money management, so following their daily service with tight money management makes it all so good!