June 29 Greece Market Update and Falling Stock Scan

Markets got a rough start to the week with a gap-down and trend day lower as Risk-On Money Flow took over following bearish news from Greece over the weekend.

What’s going on now and what levels are important? Let’s see:

Here’s a key strategy planning quote from last night’s members-only update:

At times like this when price is fairly balanced [at 2,100], get ready to play the movement away from this level as one side wins the “battle or balance” and the other side loses (exiting with their stop-losses).

Continue to receive real-time, detailed strategy planning by joining as an Afraid to Trade full member.

Price did break (gap) early under the 2,100 level and the sellers (bears) clearly won the battle, collapsing the market lower toward the 2,070 target zone from our higher timeframe trading range target.

We’re clearly focusing on this level for additional sell or liquidation (Risk-Off) action or else a bounce up off 2,070 from divergences.

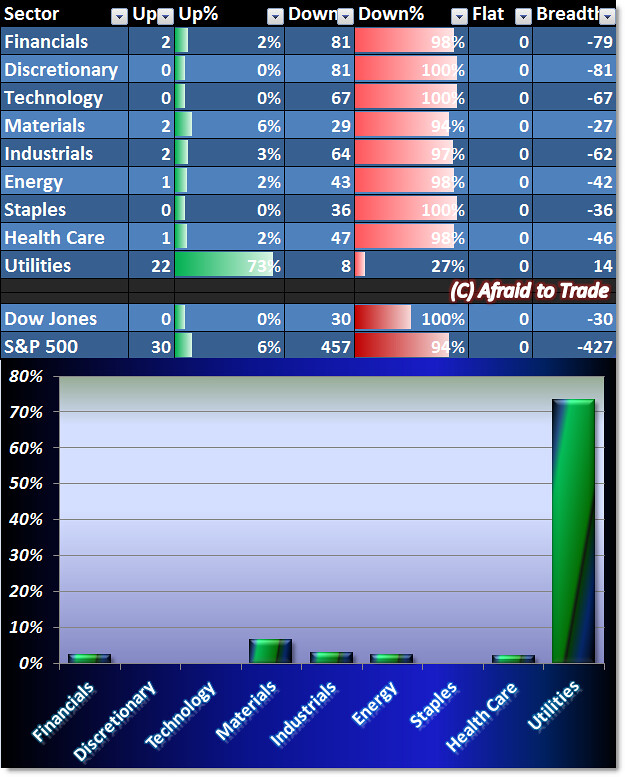

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

It’s hard to find any stock that’s positive today but we do see surprise strength in the Utilities Sector.

Utilities are a defensive “Risk-Off” category of stocks that tend to do well during bearish periods.

All other stocks and sectors – as listed in our S&P 500 grid above – are negative on today’s trend day.

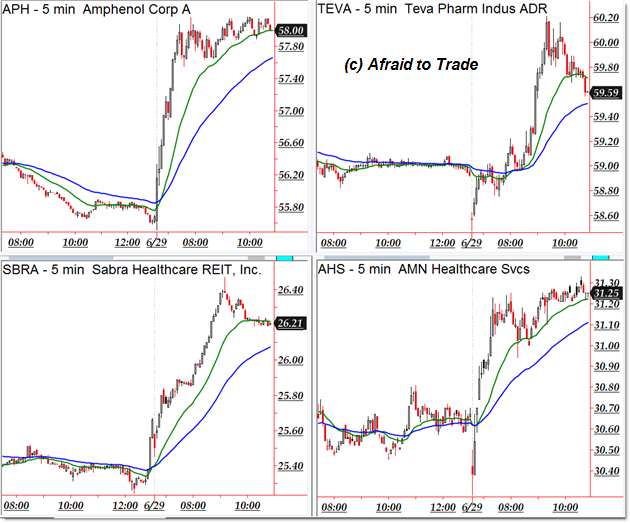

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Amphenol (APH), Teva Pharma (TEVA), Sabra Health Care (SBRA), and AMN Health Care (AHS)

Bearish downtrending candidates include the following stocks from our “weakness” scan:

Goodyear Tire (GT), Assured Guaranty (AGO), Magna Int’l (MGA), and LinkedIn (LNKD)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Greece has really played gigantic role in recent weeks and has given huge chance of profits for all. Still we are waiting for further happening to decide what’s going to happen, I am fairly lucky that working with high class broker has helped me big time, I am trading with OctaFX and due to their dead on accurate service, I have been able to get decent results. I have been following it since last 4 years and over that period I have got 80% results.