June 3 Reversal Retracement Stock Scan and Midday Update

Wow – price actually can trade lower! For a while that is.

Let’s take a look at today’s intraday levels in the S&P 500 (structure), note the message from Sector Breadth, and then finish with today’s trending stock candidates.

We had a gap down, near-fill of the gap, and then downtrend continuation back to the session low near 1,919.

From there, positive divergences preceded a sharp upside bounce (one of many) and break of a falling trendline, switching the price bias of the day back to the “bullish” side as long as price can remain above the 1,920 level.

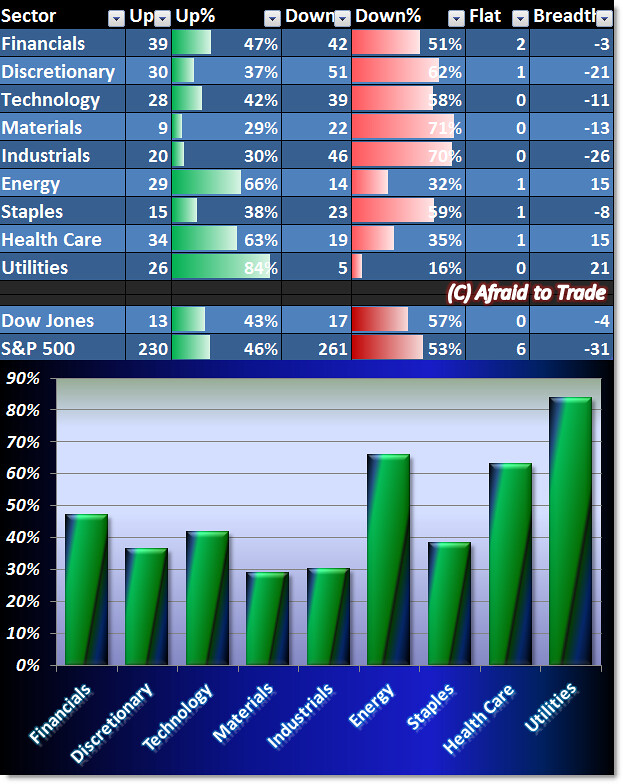

Midday Sector Breadth sends a cautious/bearish money flow message:

Just over half of the S&P 500 and Dow Jones stocks are negative on today’s session, and all sectors except Energy, Health Care, and Utilites show negative breadth.

It’s typically a bearish sign when we see Utilities, Health Care and Staples outperforming all other sectors (all of which are clustered together today except the three leaders).

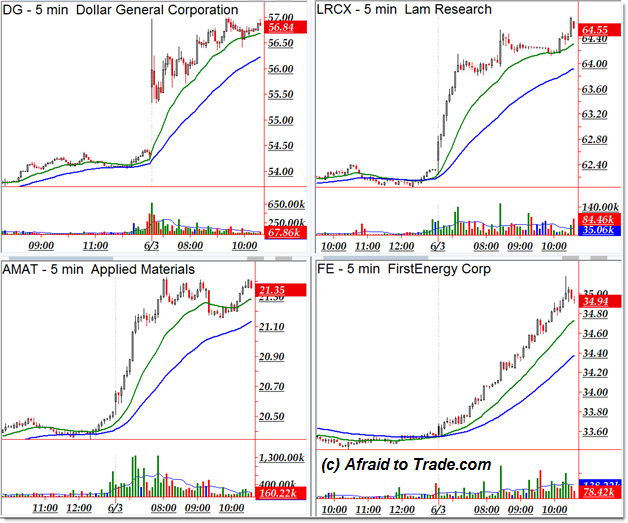

Finally, we can turn to pro-trend bullish stock candidates like these below:

Dollar General (DG), Lam Research (LRCX), Applied Materials (AMAT), and FirstEnergy Corp (FE).

Downtrending stock candidates may include the following candidates from our scan:

The Mosaic Company (MOS), Harris Corp (HRS), Archer-Daniels Midland (ADM), and Norfolk Southern (NSC).

Continue watching the intraday S&P 500 levels for a Range Day or continued surprise to the upside.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).