June 4 Breakdown Market Update and Big Stock Scan

The range broke and price collapsed toward – then under – the 2,100 target!

Which stocks topped our scan of big trend movers today?

Let’s take a look at the current picture and plan the next swing in the market:

The “Range Ping-Pong” Environment ended today with price initially breaking under the 2,115 trendline.

This set up a sell-swing price pathway (highlighted to members) toward the 2,100 target.

It was possible to play little retracement or flag trades on the journey down toward this level.

After an initial bounce, sellers once again took over, collapsing the market under 2,100 toward our 2,090 target.

At this point, monitor the 2,095 pivot and of course the 2,100 level for a “Trap Reversal” outcome.

Otherwise, it’s bearish under the 2,095 and 2,090 pivots should price continue its trend lower.

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Yesterday revealed a picture of bullishness and today shifts the perspective strongly to the sell side.

As we saw earlier this morning in the Multi-Market Money Flow, we’re seeing a shift to Risk-Off Flow.

Utilities – defensive – top today’s Sector Strength with “only” 35% of stocks positive right now.

All other sectors are seeing strong liquidation as highlighted – Risk-Off Money Flow.

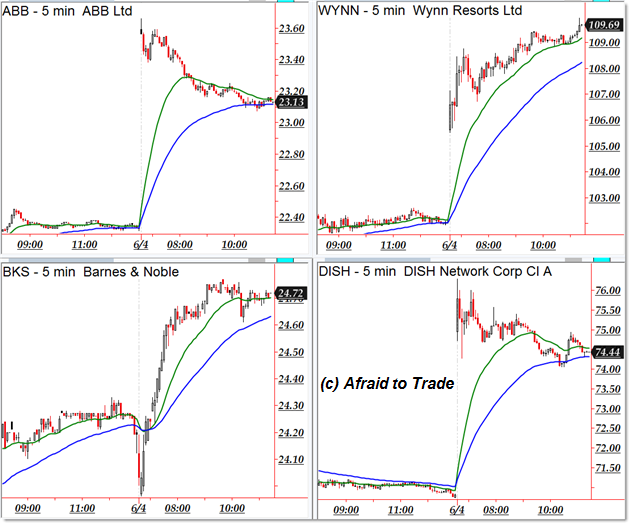

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

ABB, Wynn Resorts (WYNN0, Barnes and Noble (BKS), and DISH Network (see earlier breakout update).

Bearish downtrending candidates include the following stocks from our “weakness” scan:

STERIS Corp (STE), GlaxoSmithKline (GSK), Dupont (DD), and Iron Mountain REIT (IRM)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

It’s looking a good chance for reversal, but obviously there is enough risk that might lead us into thinking it’s not right, but I believe as a trader we have to take little bit of risk to be successful. I am in good comfortable zone with OctaFX broker, as they have healthy rebate system where I get 15 dollars profits per lot size trade, it helps me feel comfortable and I can attempt risky trades like these without any major fear of losing.