March 10 Midday Update and Super Stock Scan

A Triangle Breakout, a move down from resistance, and another reversal off the lows. What else can this day throw at us?!

Let’s update our levels for the S&P 500 Index and note the big trending stocks today:

The prior two sessions developed a Symmetrical Triangle pattern and price broke free of the upper boundary (a buy signal) on the opening gap above 1,990.

The market lunged higher toward the 2,000 then 2,005 (prior high) targets at which time a reversal down from the target set in motion a bearish collapse.

Ultimately price reversed off the 1,970 higher timeframe support level on positive divergences mid-day.

Receive daily updates, planning, and education by joining the Afraid to Trade Premium Membership.

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

With the volatile action, Sector Money Flow is mixed.

Materials and Utilities are the strongest sectors of the day as all other sectors perform beneath the 30% Breadth line.

Here’s a top-level or full-perspective view of today’s S&P 500 stock performance (courtesy of FinViz.com).

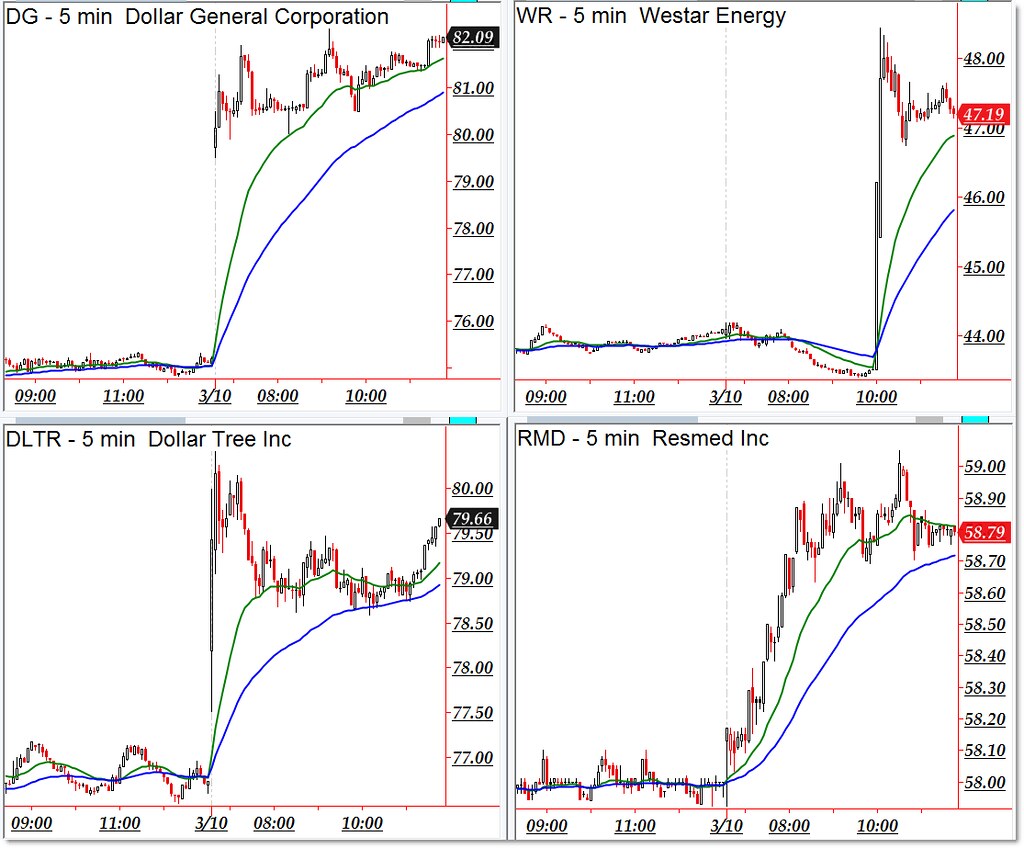

Here are today’s strongest trending (intraday) names – candidates for pro-trend continuation:

Dollar General (DG), Westar Energy (WR), Dollar Tree (DLTR), and Resmed (RMD)

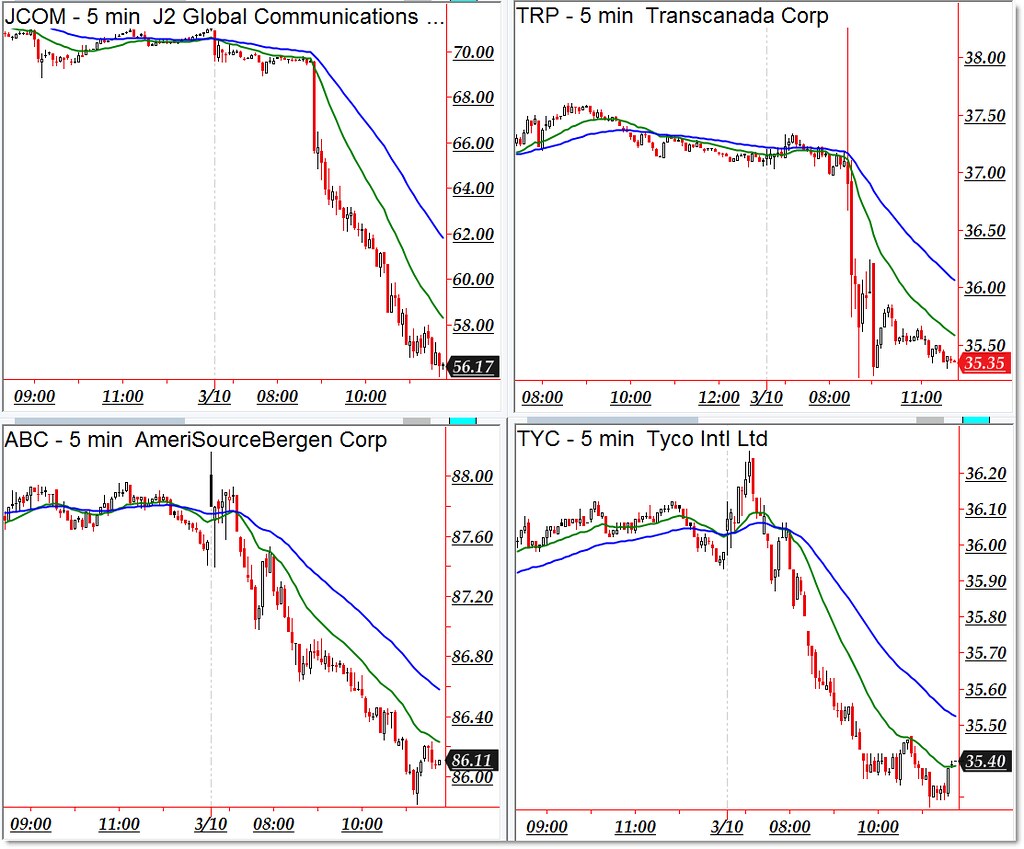

Bearish downtrending candidates include the following stocks from our “weakness” scan:

J2 Global (JCOM), Transcanada (TRP), AmeriSourceBergen (ABC), and Tyco International (TYC)

Follow along with members of the Afraid to Trade Premium Membership for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

One Comment

Comments are closed.