March 12 Big Bull Market Update and Trending Stock Scan

As was suggested in yesterday’s post, stocks stabilized off support with positive divergences and today we’re seeing the logical rally-bounce higher – and it’s a big rally.

Buyers stepped in to support the market – at least twice – into the 2,040 S&P 500 pivot and kept it up into today.

Let’s update our key levels, highlight the divergence, and of course note trending stocks today:

First, review yesterday’s mid-day update for a real-time glance at the lengthy positive divergence at support and compare the outcome – exactly what should have happened – to today’s bounce.

Members also had a deeper discussion of targets, inflection points, and likely price pathways that are realized today.

Quite simply, we expected the market to trade (inflect) up off the 2,040 pivot toward the current 2,060 level.

From this point into the close, we’re monitoring the 2,060 target and the move is complete – use 2,600 as the current pivot.

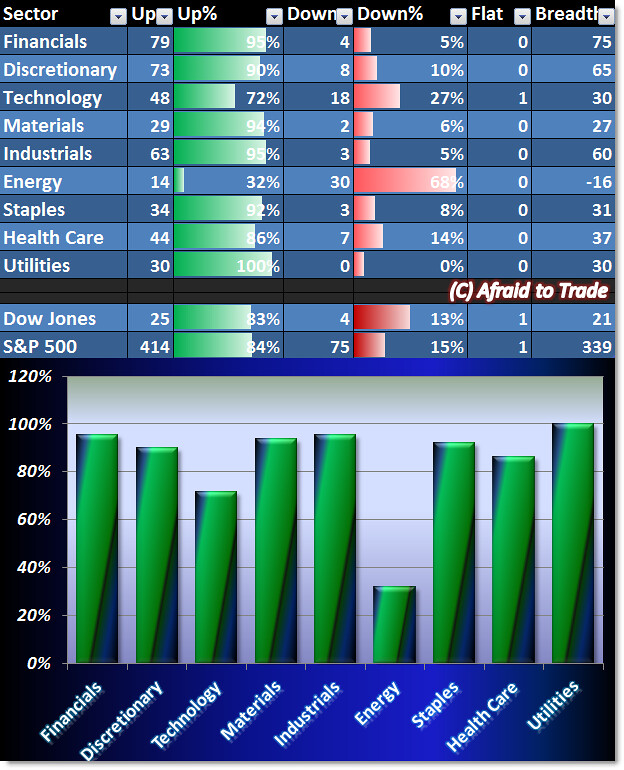

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Again, yesterday’s Sector Breadth Chart – along with the positive Market Internal Divergence – strongly suggested higher odds for a bounce-rally event today.

We’re seeing the bounce-rally off support and today’s Breadth Chart is just about as bullish as we can get.

The weakest sector is Energy, which isn’t that bad of a signal given the broader strength across the board.

We won’t fight this clear trend in bullish money flow – go where the money goes.

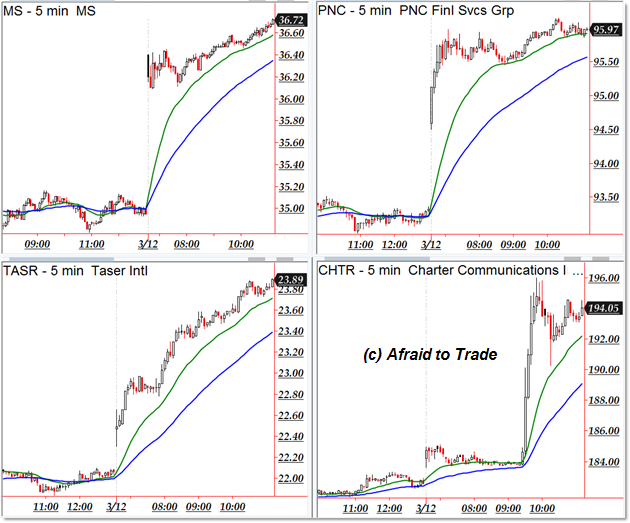

We have potential bullish trend continuation plays in the following stocks from our scan:

MS, PNC Financial (PNC), Taser (TASR), and Charter (CHTR)

Potential downtrending candidates exist in stocks showing relative weakness today:

Acadia (ACAD), Harley-Davidson (HOG), Microsoft (MSFT), Targa (TRGP)

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

Nice analysis, if you want to share more you should have a look to http://www.investwall.com a collaborative platform where traders & investors exchange ideas.

afraid to trade is the good strategy of technical analysis but I am using this by 4 years and giving me 50 pips daily. fx live

I love this blog since there are so many great points which

are highlighted here, I believe if we are really to succeed in business like this

then we need to be really aware of everything. Right now I am trading with

OctaFX broker and with them, it’s always pretty special for me with their low

spreads, high leverage while there is massive rebate program available too, I’m

able to gain 15 dollars profits per lot size trade from there and this makes me

comfortable.