March 19 Retracement Market Update and Big Stock Scan

After the Federal Reserve dropped the “patient” language but reminded us that recent economic conditions have deteriorated, making a June hike less likely, stocks rallied sharply and short-sellers rushed to buy-back losing positions which helped propel price higher in a large short-squeeze.

Today’s session has seen a logical retracement of yesterday’s big move, so let’s chart our key levels.

Price completed a slingshot rally from 2,060 to 2,105 instantly and today’s session saw a 50% retrace of yesterday’s big rally.

At the moment, price is rallying up off the halfway retracement (roughly 2,085) and breaking above a flag or triangle/wedge price pattern.

This puts the index back in the bullish “Open Air” territory as long as price remains above the 2,090 pivot.

Otherwise, note the red ‘sell’ zone under 2,090.

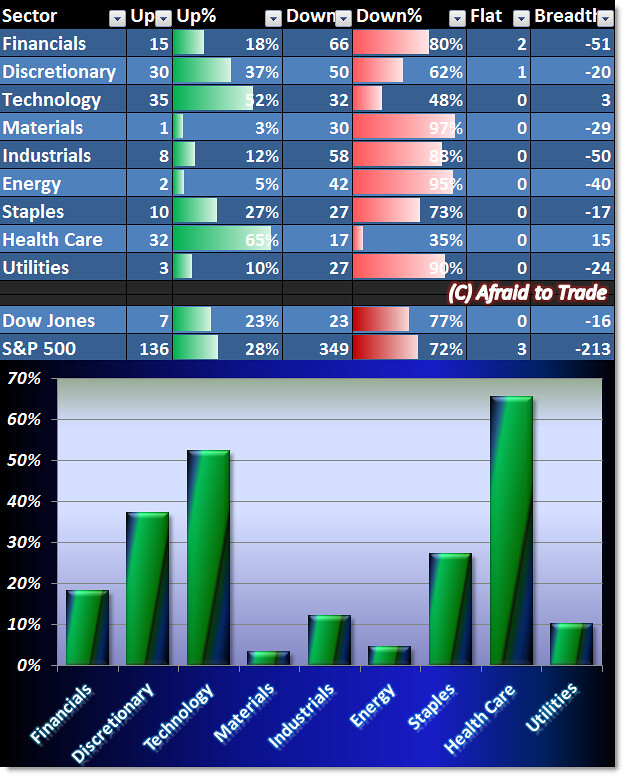

Let’s see what our Breadth Chart reveals about current market strength (or weakness):

Today’s session clearly reveals mixed Breadth with the strongest sectors Technology and Health Care outshining all other sectors.

The weakest sectors are Materials, Energy, and Utilities where Breadth (positive stocks) nears zero.

The message today is generally bearish but we could see that shift more bullish should stocks rally and remain above 2,090 as mentioned above.

Otherwise, under 2,090 suggests that Breadth was correct – bearish positions were favored today.

We have potential bullish trend continuation plays in the following stocks from our scan:

Kite Pharma (KITE), Isis Pharma (ISIS), Vipshop (VIPS), and Wynn Resorts (WYNN).

Potential downtrending candidates exist in stocks showing relative weakness today:

YELP, Agrium (AGU), Potash (POT), and ETrade (ETFC)

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

It’s amazing to see such a massive movement because this is not something we see daily; therefore I prefer to work with a plan that can overcome any movement or any unexpected situation. I am not able to create such plan but due to OctaFX broker, I am still fairly happy because I am able to earn 15 USD per lot size, so this gives me power to face and tackle any situations given situation and yet stay in profits.