March 21 Intraday Sector Breadth and Trending Stocks

What is Sector Breadth revealing about the health of today’s rally, and which stocks are the best candidates for possible trend day trading strategies?

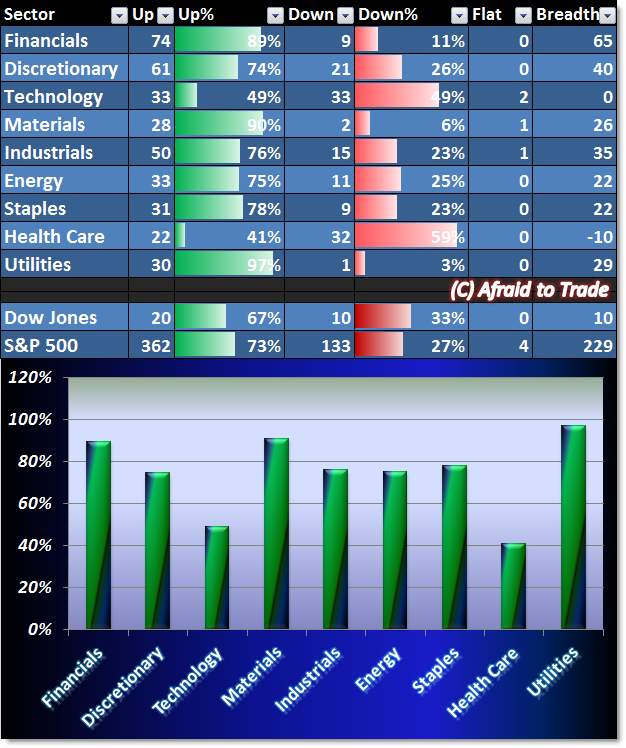

Let’s start with Sector Breadth and go forward from there:

At the moment, 73% of S&P 500 stocks are up during today’s session while 67% of Dow Jones stocks are higher.

Our strongest sectors include Financials (again), Materials, and a sleeper/surprise sector – Utilities.

Keep in mind that Utilities have rotated from a top sector during the sell-off to a bottom sector during this week’s rally. Today, they rise to the top of the Sector Breadth list with almost all (97%) of S&P Utility Sector stocks trading higher.

See my prior post “Sector Strength in Sleeper Utilities” for additional background.

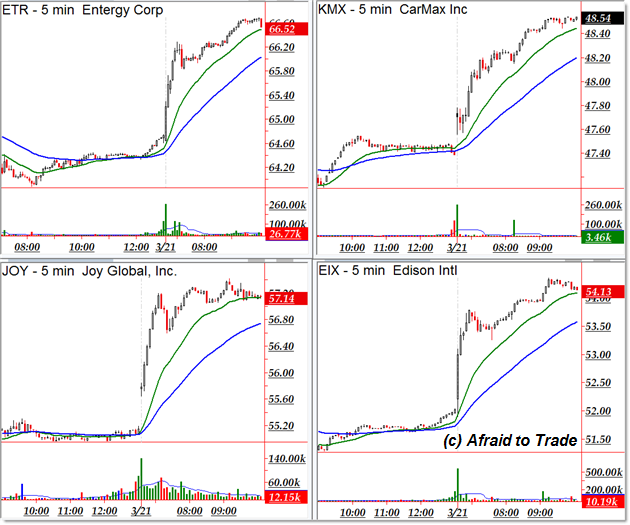

Now, let’s turn to our intraday potential trend day candidates:

Our ‘big intraday names’ today include Entergy Corp (ETR), CarMax (KMX), Joy Global which also topped the downtrending list from March 19 (JOY), and finally Edison International (EIX).

Our intraday downtrending – or bullish reversal (depending on how you use this scan) – stock lists includes Alexion Pharma (ALXN), popular name Biogen (BIIB), Lennar Corp (LEN), and Perrigo Co (PRGO).

Have a great weekend and enjoy the rest of Friday’s trading session!

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s new book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).