Market Internals Deteriorate Well in Advance of Dec 31 Selloff

Key Market Internal signals flashed negative divergences and non-confirmations of recent S&P 500 and SPY 2009 price highs, setting up the high probability for a reversal to the downside.

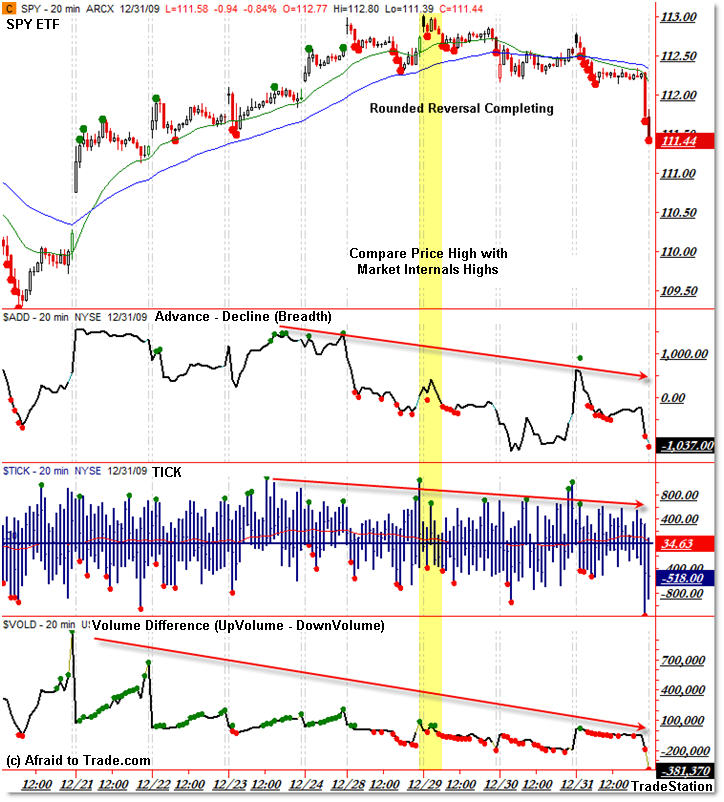

I wanted to highlight a chart I’ve been showing to members of the daily Idealized Trades Reports since Wednesday evening – we’re now seeing the downward action forecast by the plunge in Market Internals. Let’s take a look at the updated chart.

The chart is understandably overwhelming at first – let’s take it level by level.

Using TradeStation, I’ve created a chart of the SPY (which could easily be the S&P 500 Index instead of the ETF) showing the 20 and 50 period EMA on the 20-minute chart (which, also, could just as easily be a 30 min or 15 min chart – we’re more interested in comparing price swing highs to internals/indicator swing highs to see if they are in alignment… they’re not).

In the first panel under price, we see the Breadth (NYSE Advancers minus Decliners) on the day as a number (line) tabulated for each 20-minute period.

The line peaked on December 21st, suggesting internal strength and higher prices yet to come. The line retested the highs (1,500 net advancing stocks) a second time on December 23 and 24th, but then began a steady and obvious decline from there.

On each graph, I’m using the “new high or low for the day” dot indicator – red for new intraday low and green for new intraday high. This helps me see readings quicker without having to squint.

Breadth made a new swing low under 1,000 on Wednesday, forecasting lower index prices ahead.

The second panel shows the TICK, which is shown as a bar graph instead of a clean line graph. It’s not as easy to read, but the intraday high levels of the TICK began to form lower successive peaks as time progressed.

Finally, the third panel shows the $VOLD or “Volume Difference,” which refers to the VOLUME flowing into advancing stocks on the day minus the volume flowing into declining stocks on the day (similar to the TRIN in a way).

I’ve been showing in the intraday reports how the $VOLD indicator has given ‘heads up’ on certain days, as on December 28th.

The $VOLD also peaked on the open of December 21st (like Breadth) which forecast higher index prices yet to come in a classic internal “sign of strength.”

However, as price rallied from that point, the $VOLD formed lower highs and lower lows all the way to today, when price literally fell off the mountain with 30 minutes left to trade in 2009.

I had previously been highlighting the potential for a “Rounded Reversal” structure to form at the highs – it appears the pattern is completing now.

A few years ago, I used to give very little attention to key market internals – now I place them in the forefront of making most trading decisions when it comes to market structure and potential pathways ahead.

Take the time and energy to get acquainted with market internals if you haven’t done so already.

Oh, and have a Happy New Year everyone!

Corey Rosenbloom

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Wow, mkt internals are often this clear? Great presentation.

Happy New Year corey. Just out of curiosity, why did you go with a 20 min. chart?

You too, Dominick!

I chose the 20 as it was a compromise between the 15 and 30 – the 15 didn't showed too many bars in the window I wanted and the 30 didn't show enough.

I wouldn't trade off the 20, but it was a good compromise when looking at the recent swing up and the decline in internals.

Unfortunately, no – and that's why I got so excited when I started picking up on this pattern mid-week.

Internals are helpful because they show the underpinnings of the market in terms of participation of stocks in an index, and what a divergence means is more stocks are breaking down while the big cap names – Intel, Exxon, etc – are making highs pushing the index higher slightly with fewer stocks participating. Foreshadows reversal.

But no, not all tops or bottoms are this clear. It'd be too easy if they were!

Hi Corey,

I think volume in general is expected to be a bit scitzo the last week in December. What would you want to see the first week of this month if the goal were to satiate the bulls?

Hi Corey,

I think volume in general is expected to be a bit scitzo the last week in December. What would you want to see the first week of this month if the goal were to satiate the bulls?