Market Struggles Desperately to Rally off Weekly Target

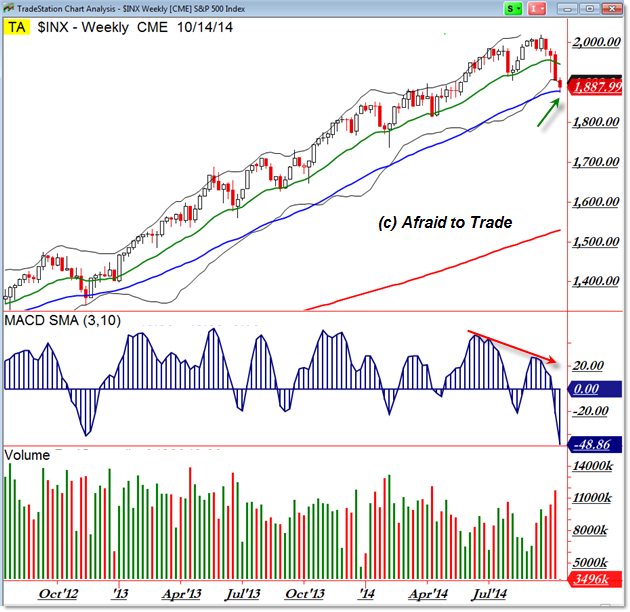

After failing at two key support levels very recently, the S&P 500 and broader US Equity Markets have one more major support test and potential bounce as another downside target is fully achieved.

Let’s see the support target and note the positive divergences developing into this level:

We’ll quickly note that the 1,925 price confluence (rectangle) then the recent confluence of the rising 200 day SMA with the 1,900 “Round Number” level also failed to stop the bearish action.

When support levels fail, it often sets up great trading opportunities to play short (bearishly) into a fast-moving market, as has been the case recently.

Similarly, when resistance levels fail and price breaks higher, we can join into likely breakout events as traders are trapped on the wrong side of price action and forced quickly to cover losses (exacerbating the price movement).

Our key focal point now is the rising 50 week EMA (blue) with the 1,875 level and so far, we’re seeing buyers rush in to support this level, resulting in a potential bounce.

Market Internals once again forecast (suggest) a likely bounce/rally outcome here:

The last time we saw a major “Triple Internal Divergence” was October 13th which produced a small rally towards the falling upper trendline.

Before that was the big rally of October 8th as detailed in this real-time update (useful for an educational example).

This brings us to our planning for today’s session and likely beyond that.

Lengthy positive momentum divergences at a critical support level suggest we should be cautious bulls above this level… but evolve rapidly into aggressive bears on yet another failed support-test of the market.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).

2 Comments

Comments are closed.