May 19 Trend Day Intraday Stock Update and Scan

It’s mid-day and we’re currently trending higher on strong sector breadth.

Let’s update our current intraday chart, study the message of breadth, and highlight trend day trading candidates for May 19.

The S&P 500 continued an intraday trend reversal into an uptrend off the 1,870 reference level.

After a mini-gap down, price broke to new highs and has continued its upward motion with a fresh breakout above the 1,880 reference level.

We now monitor price for the odds of a trend reversal down which would be favored on an instant break back under 1,880 which would target 1,878.

Any breakdown under 1,878 could result in further selling pressure into an “open air” downward pathway.

Of course, if price remains above these levels, the trend day structure remains in place and retracement trading strategies would be favored.

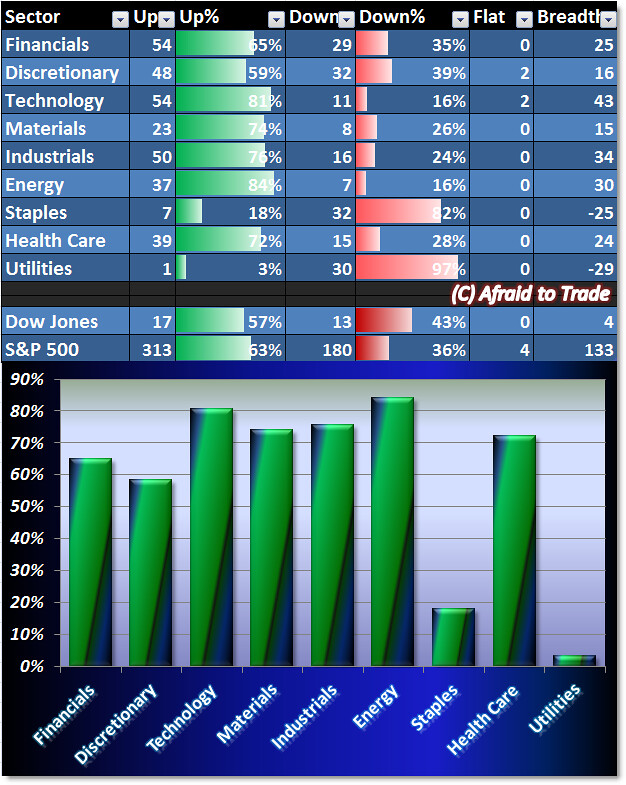

Sector Breadth suggests a strong bullish edge:

We divide the Sector Grid into “Risk On” (Financials, Tech, etc) Sectors and the “Risk Off” or Defensive sectors Staples, Health Care, and Utilities.

We can see clear strength across the board (including Energy) from our sector grid where the worst performance is in Staples (less than 20% of stocks positive) and Utilities (only one stock is positive right now).

If this trend continues, we would look for higher prices for the S&P 500.

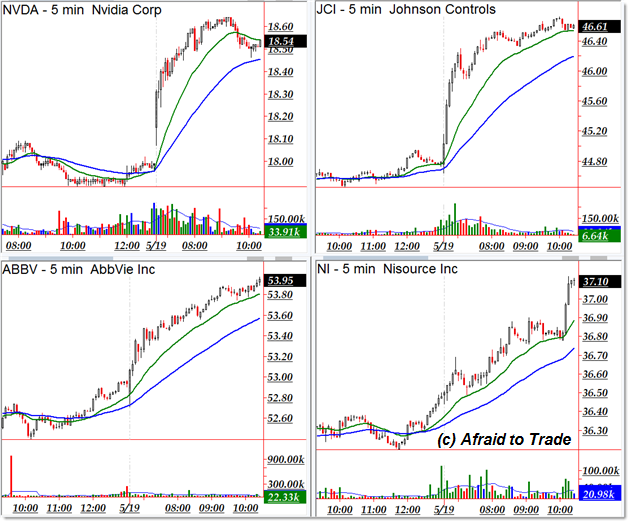

The following names are just some of the bullish intraday trend day trading candidates:

Nvidia Corp (NVDA), Johnson Controls (JCI), AbbVie Inc (ABBV) and Nisource Inc (NI).

On any day no matter how bullish, there are always stocks trending down which may serve as good candidates on a reversal (the are relative strength ‘losers’ today):

Duke Energy (DUK), Newmont Mining (NEM), Dominion Resources (D) and Exelon Corp (EXC).

Speaking of Exelon, take a moment to read my ambitious “Short Sale Swing Trade Candidate Exelon and Lesson” post which suggested a bearish reversal was likely – and so far, that has proven true.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).