May 21 Rally and Range Intraday Trading Update

Today’s action saw a continuation rally off the 1,870 support and reversal play from yesterday’s session.

Let’s take a look at the current intraday levels, Sector Breadth, and potential Trend Day Continuation stocks:

For intraday traders, we note the upper resistance target into the 1,885/1,886 level as our key reference point.

Beyond that, we’ll reference the simple 1,880 level as the lower support and will play “ping-pong” or neutral strategies between this 5 to 6 point intraday range.

We’ll look to trade a breakdown short that continues on a movement down away from 1,880 (multi-support level) and otherwise will trade bullishly to capture the “short-squeeze” impulse that may quickly develop on a continuation of the uptrend (bullish money flow) and breakout to new intraday highs.

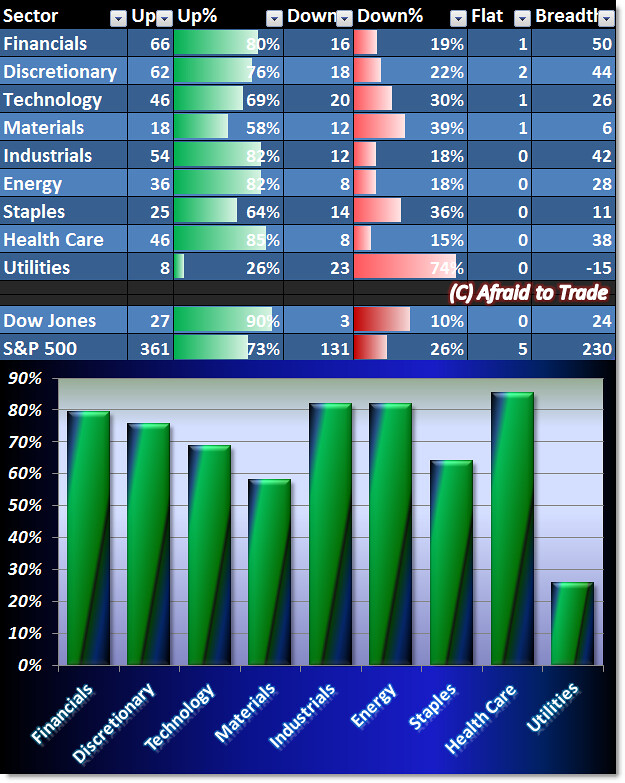

Sector Breadth does confirm the bullish money flow across all sectors… except lonely Utilities:

We see Sector Strength across the board while Utilities ($XLU) lags that pack (only 25% of S&P 500 Utilities Stocks are positive at this moment).

If you’re looking to play intraday strength, focus on strong stocks in strong sectors and avoid trading lagging sectors (like Utilities today).

Here are a few selected stock candidates from our intraday relative strength scan:

Our good friend Netflix (NFLX) continues its breakout along with Johnson Controls (JCI), DaVita Health Care (DVA), and leading company Exxon Mobil (XOM).

See my post from Monday that referenced a bullish breakout into Open Air (and trade updates) for Netflix.

No matter how bullish the session, not all stocks take part in the festivities:

Bearish or sell-day trend day continuation candidates include Salesforce.com (CRM), International Paper (IP), Tesoro Corp (TSO), and Century Link (CTL).

Continue monitoring the intraday reference levels in the context of the broader “Rising Range/Rectangle” levels that I highlighted this morning on the Dow Jones and S&P 500.

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).