May 9 Double Bottom Reversal Intraday Trading Update

This week has seen many intraday reversals that have tricked some traders, and today’s session is no exception.

Let’s jump straight into today’s mid-day market update and focus on what’s important for the rest of the session.

This morning continued the intraday reversal and downtrend against the 1,890 level. Price then triple bottomed on positive TICK (internal) divergences off the 1,868 level to create another intraday reversal higher.

We’re focusing on the 1,878 level which is the 50% Fibonacci Retracement with respect to the EMA crossover and price support into 1,873. Focus on these levels going forward.

Look to be neutral between 1,873 and 1,878 and otherwise breakout bullish above 1,881 (open air) and bearish under 1,873/1,872.50.

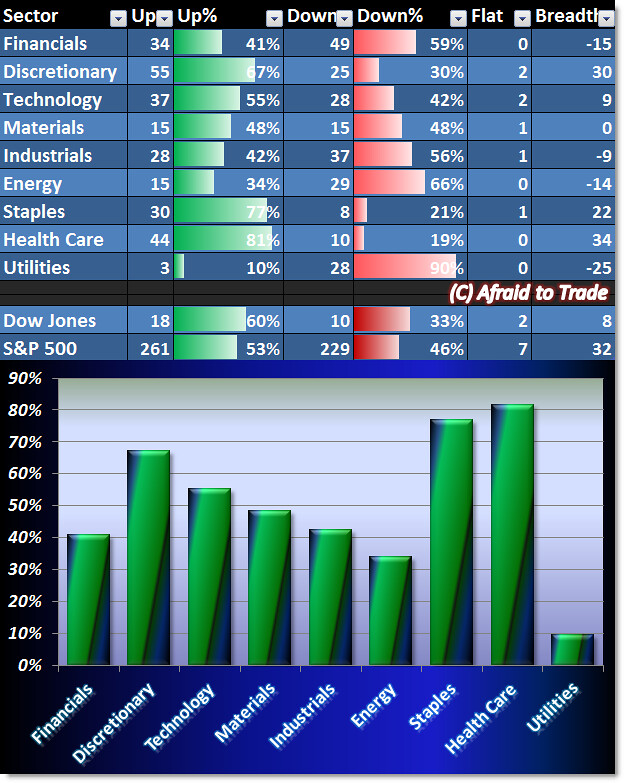

Sector Breadth warns of a little caution at the moment:

Sector Breadth is strongest in Staples and Health Care, and we continue the situation we saw yesterday where formerly strong Utilities and Energy are the session’s weakest sectors.

Otherwise we continue to see strength in Consumer Discretionary/Retail along with Technology, thus sending another “mixed message” from sector breadth.

Top intraday trending candidates include Computer Sciences Corp (CSC), Kellogg Corp (K), McKesson (MCK), and Urban Outfitters (URBN).

Finally, our downtrending candidates are Teco Energy (TE), PG&E Corp (PCG), Wisconsin Energy (WEC), and CMS Energy (CMS).

Don’t be misled by the word “Energy” in the names of these stocks in the downtrending list. All four are part of the Utility Sector where 10% of stocks are positive at the moment (at this time yesterday, zero stocks were positive on the session).

Follow along with members of the Daily Commentary and Idealized Trades summaries for real-time updates and additional trade planning.

Corey Rosenbloom, CMT

Afraid to Trade.com

Follow Corey on Twitter: http://twitter.com/afraidtotrade

Corey’s book The Complete Trading Course (Wiley Finance) is now available along with the newly released Profiting from the Life Cycle of a Stock Trend presentation (also from Wiley).